Payday loans are short-term loans. They help people in urgent need of cash. But, they come with pros and cons. It is important to know both sides. This helps you make a good decision.

What Are Payday Loans?

Payday loans are small loans. You borrow them for a short time. Usually, until your next paycheck. They are easy to get. But, they have high-interest rates. Payday loans are for emergencies only. They are not for long-term needs.

How Do Payday Loans Work?

You apply for a payday loan. You show proof of income. The lender checks your details. If approved, you get the money. You repay the loan when you get your paycheck. It is simple and fast.

Credit: fastercapital.com

The Pros of Payday Loans

1. Fast Approval

Payday loans are quick. You can get approval in minutes. This is helpful in emergencies. When you need money fast, payday loans can help.

2. Easy To Apply

The application process is easy. You only need basic information. Proof of income is enough. You do not need a good credit score. Almost anyone can apply.

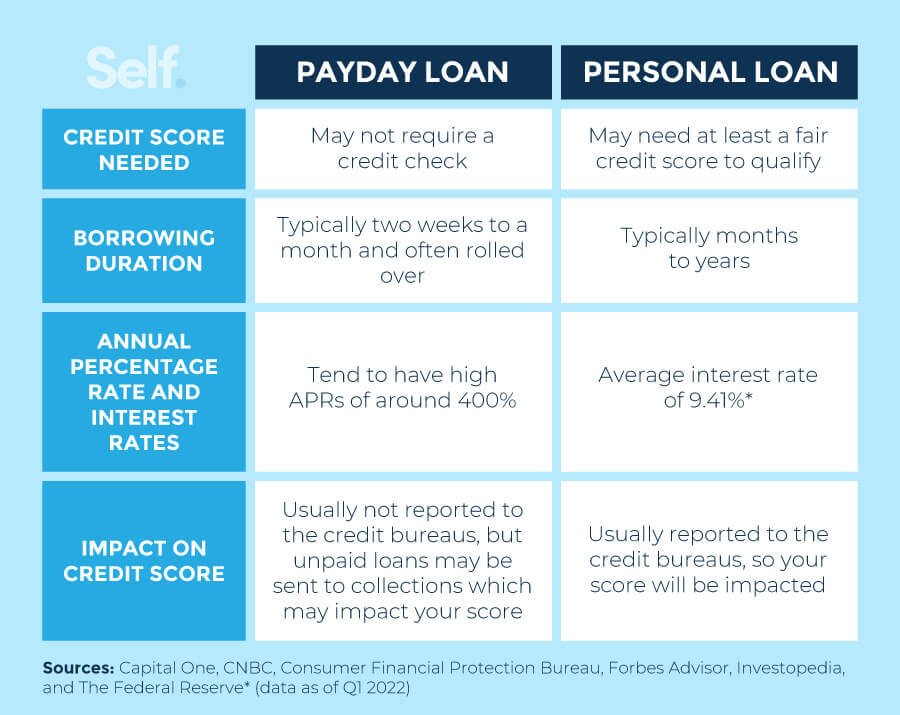

3. No Credit Check

Most payday lenders do not check credit. This is good for people with bad credit. You can get a loan even with a low credit score.

4. Convenient

You can apply online or in person. Many lenders are open 24/7. This makes payday loans very convenient.

5. Short-term Commitment

Payday loans are short-term. You repay them quickly. This means you are not in debt for long.

Credit: www.self.inc

The Cons of Payday Loans

1. High Interest Rates

Payday loans have high-interest rates. This makes them expensive. You may end up paying much more than you borrowed.

2. Short Repayment Period

You must repay the loan quickly. Usually, within two weeks. This can be hard if you are short on money.

3. Risk Of Debt Cycle

Many people get trapped in a debt cycle. They take another payday loan to repay the first one. This can lead to more debt.

4. Fees And Penalties

There are many fees. Late payment fees, processing fees, and more. These can add up. They make the loan even more expensive.

5. Limited Loan Amount

Payday loans are small. Usually, only a few hundred dollars. They are not enough for big expenses.

When to Consider Payday Loans

Payday loans are for emergencies. Only use them when you have no other option. If you need money fast and have no other way, consider a payday loan. But, be careful. Know the risks. Make sure you can repay the loan on time.

Alternatives to Payday Loans

There are other options. Consider these before taking a payday loan:

- Borrow from friends or family

- Use a credit card

- Get a personal loan

- Ask for a salary advance

- Explore community assistance programs

These options may have lower costs. They may be better for you.

Frequently Asked Questions

What Are Payday Loans?

Payday loans are short-term, high-interest loans. They are due on your next payday.

How Do Payday Loans Work?

You borrow a small amount. You repay it with interest on your next payday.

What Are The Pros Of Payday Loans?

Quick access to cash. Easy to qualify. No credit check needed.

What Are The Cons Of Payday Loans?

High interest rates. Short repayment period. Possible debt cycle.

Conclusion

Payday loans have pros and cons. They are fast and easy. But, they are expensive and risky. Use them only for emergencies. Always explore other options first. Be smart about borrowing money. Understand the terms and conditions. Make sure you can repay on time.

By knowing the pros and cons, you can make a good decision. Stay informed. Stay safe. Use payday loans wisely.