Do you need money before your next paycheck? You are not alone. Many people face this problem. A paycheck loan can help you. But what is a paycheck loan? Let’s find out.

What is a Paycheck Loan?

A paycheck loan is a short-term loan. It helps you get money until your next paycheck. It is also called a payday loan. You borrow a small amount of money. You pay it back with your next paycheck.

How Does A Paycheck Loan Work?

The process is simple. You apply for the loan. The lender checks your information. If approved, you get the money. You repay the loan when you get your paycheck.

Steps To Get A Paycheck Loan

- Fill out an application.

- Provide proof of income.

- Wait for approval.

- Receive the money.

- Repay the loan on time.

Credit: www.pandalawfirm.com

Benefits of a Paycheck Loan

Paycheck loans can be helpful. Here are some benefits:

Fast Cash

You get money quickly. This can help in emergencies. You do not need to wait long.

Easy To Apply

The application process is simple. It takes only a few minutes.

No Credit Check

Most lenders do not check your credit score. This is good if you have bad credit.

Convenient

You can apply online or in person. This makes it easy to get the money you need.

Risks of a Paycheck Loan

Paycheck loans have risks. You need to be careful. Here are some risks:

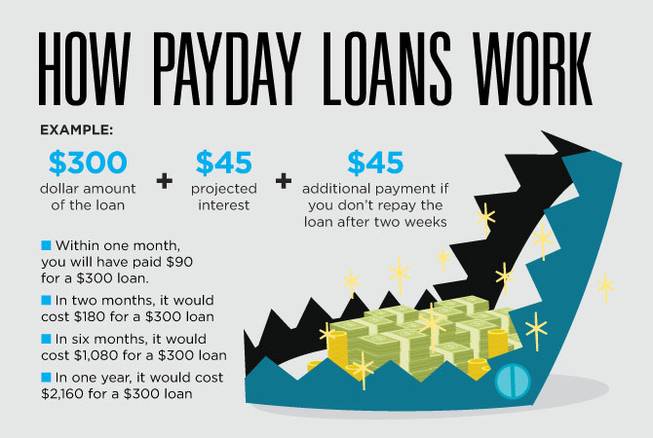

High Interest Rates

Paycheck loans have high interest rates. You can end up paying a lot of money.

Short Repayment Period

You need to repay the loan quickly. This can be hard if you do not have enough money.

Debt Cycle

You can get stuck in a debt cycle. You take another loan to repay the first one. This can be bad for your finances.

Fees And Penalties

There can be extra fees and penalties. These add to the cost of the loan.

Who Should Use a Paycheck Loan?

Paycheck loans are not for everyone. They can be helpful in emergencies. Here are some examples:

- Unexpected medical bills.

- Car repairs.

- Urgent home repairs.

- Other emergencies.

Alternatives to Paycheck Loans

There are other options. Here are some alternatives:

Personal Loans

Personal loans have lower interest rates. They give you more time to repay.

Credit Cards

You can use a credit card. This can be cheaper than a paycheck loan.

Borrow From Friends Or Family

You can ask friends or family for help. They may not charge interest.

Local Assistance Programs

Some local programs offer help. They can give you money or other support.

:max_bytes(150000):strip_icc()/what-are-basic-requirements-qualify-payday-loan.aspFinal-1b6684790a684488bc21480e6dced3b2.jpg)

Credit: www.investopedia.com

How to Choose the Right Paycheck Loan

Choosing the right loan is important. Here are some tips:

Compare Lenders

Look at different lenders. Compare their interest rates and fees.

Check Reviews

Read reviews from other borrowers. This can help you find a good lender.

Understand The Terms

Read the loan terms carefully. Make sure you understand everything.

Ask Questions

If you are unsure, ask questions. A good lender will help you.

Repaying a Paycheck Loan

Repaying the loan is important. Here are some tips to help you:

Make A Budget

Create a budget. This helps you manage your money.

Set Reminders

Set reminders to repay the loan on time. This avoids extra fees.

Save Money

Try to save some money each month. This helps in emergencies.

Ask For Help

If you cannot repay, ask for help. Talk to the lender. They may offer solutions.

Frequently Asked Questions

What Is A Paycheck Loan?

A paycheck loan is a short-term loan. It helps cover expenses until your next paycheck.

How Does A Paycheck Loan Work?

You borrow money and repay it with your next paycheck. Simple and fast.

Who Can Apply For A Paycheck Loan?

Anyone with a steady income can apply. You must be 18 or older.

Are Paycheck Loans Safe To Use?

They can be safe if used responsibly. Always read the terms first.

Conclusion

Paycheck loans can be helpful. They provide fast cash in emergencies. But they have risks. High interest rates and fees can add up. Use them wisely. Consider other options if possible. Always repay on time. This helps you avoid more debt. Choose the right lender. Understand the terms. Paycheck loans are a tool. Use them carefully. They can help you when you need it most.