Many people need money sometimes. Two common options are personal loans and payday loans. This guide will help you understand these loans. You can choose the best loan for you.

What is a Personal Loan?

A personal loan is money you borrow from a bank or lender. You pay it back over time. Usually, you have months or years to pay it back. Personal loans often have lower interest rates.

What is a Payday Loan?

A payday loan is a short-term loan. You borrow a small amount of money. You pay it back when you get your next paycheck. Payday loans usually have higher interest rates.

Key Differences Between Personal Loans and Payday Loans

| Personal Loans | Payday Loans |

|---|---|

| Lower interest rates | Higher interest rates |

| Longer repayment terms | Short repayment terms |

| Larger loan amounts | Smaller loan amounts |

| Requires credit check | No credit check needed |

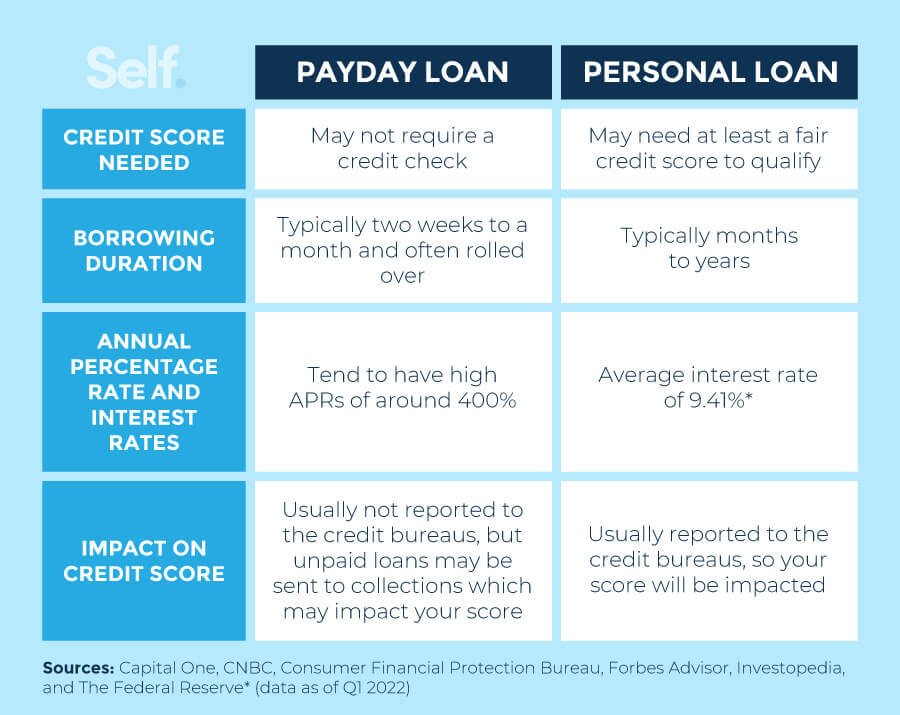

Interest Rates

Interest rates are important. They affect how much you pay back. Personal loans have lower interest rates. This means you pay back less money. Payday loans have higher interest rates. This means you pay back more money.

Repayment Terms

Repayment terms are how long you have to pay back the loan. Personal loans give you more time. You can have months or years. Payday loans give you less time. You usually have to pay back by your next payday.

Credit: debthammer.org

Loan Amounts

Personal loans can give you more money. You can borrow thousands of dollars. Payday loans give you less money. You can borrow a few hundred dollars.

Credit Check

Personal loans often need a credit check. Lenders look at your credit score. This helps them decide if they will give you a loan. Payday loans do not need a credit check. This makes it easier to get a payday loan.

Credit: www.self.inc

When to Choose a Personal Loan

Consider a personal loan if:

- You need a large amount of money

- You need more time to pay it back

- You have a good credit score

- You want to pay less interest

When to Choose a Payday Loan

Consider a payday loan if:

- You need a small amount of money

- You can pay it back quickly

- You do not have a good credit score

- You need money fast

Pros and Cons

Personal Loans

Pros:

- Lower interest rates

- Longer repayment terms

- Larger loan amounts

Cons:

- Requires credit check

- Longer approval process

Payday Loans

Pros:

- No credit check needed

- Quick approval process

Cons:

- Higher interest rates

- Short repayment terms

- Smaller loan amounts

Frequently Asked Questions

What Is A Personal Loan?

A personal loan is money borrowed from a bank or lender. It is repaid in fixed monthly payments.

What Is A Payday Loan?

A payday loan is a short-term loan. It is usually repaid on your next payday.

How Do Personal Loans Work?

Personal loans provide a lump sum. You repay it over time with interest.

How Do Payday Loans Work?

Payday loans give quick cash. You repay it with a high fee from your next paycheck.

Conclusion

Both personal loans and payday loans have their uses. Know your needs and choose wisely. Personal loans are better for big expenses and long term plans. Payday loans are better for small, quick cash needs. Think carefully before you decide.