Payday loans are short-term loans. They help you cover small expenses. These loans are usually for emergencies. But what about their interest rates? Let’s find out.

Understanding Payday Loans

Payday loans are small loans. They are usually due on your next payday. You can get them quickly. But, they come with high interest rates.

How Do Payday Loans Work?

First, you apply for the loan. The lender checks your income. If approved, you get the money. You must pay it back by your next payday.

Interest Rates on Payday Loans

Interest rates on payday loans are high. They can be very expensive. Let’s look at some examples.

| Loan Amount | Interest Rate | Total Repayment |

|---|---|---|

| $100 | $15 | $115 |

| $200 | $30 | $230 |

| $300 | $45 | $345 |

The table shows the interest rates. For every $100, you pay $15 extra. This is just an example. Rates can be higher or lower.

Why are Interest Rates So High?

Payday loans are easy to get. They do not need a credit check. This makes them risky for lenders. To cover this risk, lenders charge high interest rates. </p

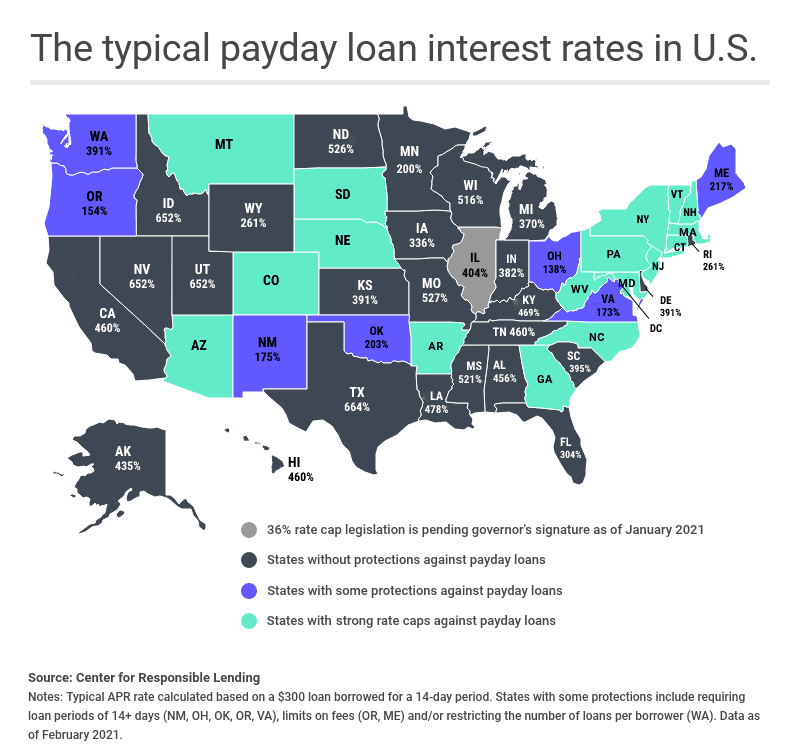

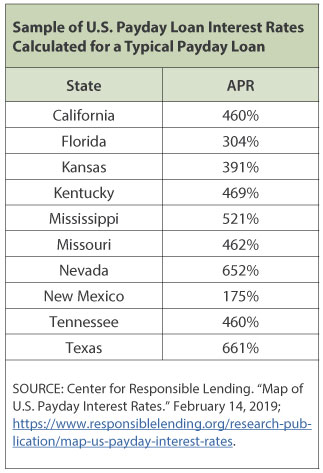

Annual Percentage Rate (APR)

APR is the yearly cost of the loan. For payday loans, APR can be over 400%. This is very high. Let’s see an example.

- You borrow $100.

- You pay back $115 in 2 weeks.

- The interest is $15.

- APR is 391%.

This shows how costly payday loans can be. Always check the APR before borrowing.

Other Costs

Payday loans can have other costs. There might be fees. These can add up quickly.

- Application fee

- Late payment fee

- Rollover fee

Be aware of these fees. They can make the loan even more expensive.

Credit: www.econlowdown.org

Credit: www.sltrib.com

Alternatives to Payday Loans

Payday loans are not the only option. There are other ways to get money. Let’s look at some alternatives.

Personal Loans

Personal loans have lower interest rates. They take longer to process. But they are less expensive.

Borrow From Friends Or Family

This can be a good option. There is no interest. But make sure to pay them back on time.

Credit Cards

Credit cards have lower interest rates. They are a better option if you can pay back quickly.

Local Assistance Programs

Some local programs offer help. They can provide small loans or grants. Check with local charities or government offices.

Frequently Asked Questions

What Are Payday Loan Interest Rates?

Payday loan interest rates are usually very high. They can range from 300% to 500% APR.

Are Payday Loan Interest Rates Regulated?

Yes, payday loan interest rates are regulated. Different countries and states have their own rules.

Why Are Payday Loan Interest Rates So High?

Payday loan interest rates are high due to short-term, high-risk nature. Lenders charge more to cover their risk.

How Do Payday Loan Interest Rates Compare To Other Loans?

Payday loans have much higher interest rates than personal or credit card loans. They are the most expensive.

Conclusion

Payday loans are quick but costly. They have high interest rates and fees. Always consider other options first. If you must get one, be sure to understand the costs. Borrow only what you can repay. Be careful with payday loans. They can help in emergencies but can also lead to more debt.