Payday loans can help in emergencies. They offer quick cash. But, how do you qualify for one? This guide will explain everything. Keep reading to learn more.

What is a Payday Loan?

A payday loan is a short-term loan. It helps when you need money fast. You usually repay it on your next payday. These loans are easy to get. But, they have high fees. <h2Basic Requirements for a Payday Loan

To qualify for a payday loan, you need to meet some basic requirements. Let’s take a look at them.

1. Age Requirement

You must be at least 18 years old. This is the legal age to get a loan.

2. Proof Of Income

You need to show proof of income. This can be a pay stub or bank statement. Lenders want to see that you can repay the loan.

3. Active Bank Account

You must have an active bank account. Lenders deposit the loan into your account. They also withdraw the repayment from it.

4. Identification

You need a valid ID. This can be a driver’s license or passport. It proves who you are.

5. Contact Information

Lenders need your contact details. This includes your phone number and email address. They use this to reach you if needed.

Steps to Apply for a Payday Loan

Applying for a payday loan is easy. Just follow these steps.

Step 1: Research Lenders

Look for reputable lenders. Read reviews and check their websites. Compare fees and terms.

Step 2: Gather Documents

Collect the required documents. These include your ID, proof of income, and bank account details.

Step 3: Fill Out The Application

Complete the application form. Provide accurate information. Double-check everything before submitting.

Step 4: Submit Your Application

Submit your application online or in person. Wait for the lender to review it.

Step 5: Receive Approval

If approved, you will get the loan amount. The money is usually deposited into your bank account.

Tips for Getting Approved

Here are some tips to increase your chances of approval.

Tip 1: Have A Steady Income

Lenders prefer borrowers with a steady income. It shows that you can repay the loan.

Tip 2: Maintain A Good Bank Account

Keep your bank account in good standing. Avoid overdrafts and negative balances.

Tip 3: Provide Accurate Information

Always provide accurate information on your application. False information can lead to rejection.

Tip 4: Choose The Right Loan Amount

Only borrow what you need. Smaller loan amounts are easier to get approved.

Tip 5: Check Your Credit History

Some lenders check your credit history. Make sure it is clean and accurate.

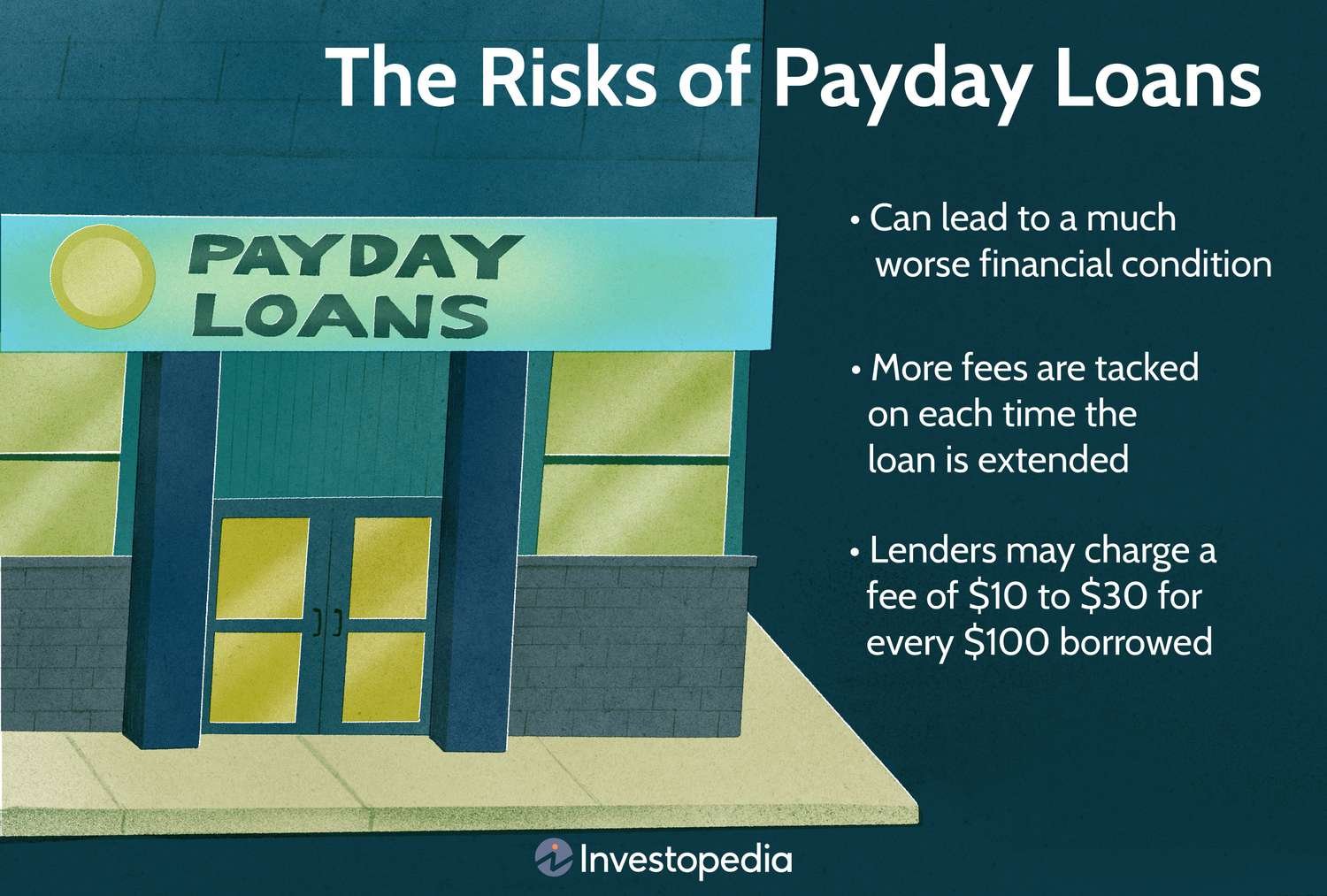

:max_bytes(150000):strip_icc()/payday-loans.asp-final-882c60fabb124a519dada443015c2eb2.png)

Credit: www.investopedia.com

Understanding Payday Loan Fees

Payday loans have fees. It is important to understand them.

Origination Fee

This is a fee for processing the loan. It is usually a percentage of the loan amount.

Late Payment Fee

If you miss a payment, you will be charged a late fee. It can be high, so try to avoid it.

Annual Percentage Rate (apr)

The APR is the yearly cost of the loan. It includes fees and interest. Payday loans often have high APRs.

Repaying Your Payday Loan

Repaying a payday loan is important. Here are some tips to help you.

Make Payments On Time

Always make your payments on time. This will avoid late fees and penalties.

Set Up Automatic Payments

Consider setting up automatic payments. This ensures you never miss a payment.

Communicate With Your Lender

If you have trouble repaying, talk to your lender. They may offer a repayment plan.

Credit: www.incharge.org

Alternatives to Payday Loans

Sometimes, payday loans are not the best option. Here are some alternatives.

Personal Loans

Personal loans often have lower fees. They can be a better option for some people.

Credit Cards

Using a credit card can be cheaper. Just be sure to pay off the balance quickly.

Borrowing From Friends Or Family

Ask friends or family for help. They may offer a loan with no fees.

Credit Union Loans

Credit unions often offer small loans. They have lower fees and better terms.

Frequently Asked Questions

What Are The Basic Requirements For A Payday Loan?

You need to be 18+, have a job, and a bank account.

How Long Does It Take To Get A Payday Loan?

Approval can happen in minutes. Funds are often available within 24 hours.

Can I Get A Payday Loan With Bad Credit?

Yes, many lenders approve payday loans even if you have bad credit.

What Documents Do I Need For A Payday Loan?

Typically, ID, proof of income, and a bank statement are required.

Conclusion

Qualifying for a payday loan is simple. Meet the basic requirements. Follow the steps to apply. Use the tips for approval. Remember, payday loans have high fees. Consider alternatives if possible. Always repay your loan on time. This will help you avoid extra costs. Good luck with your application!