Many people need money quickly. Payday loans can help. But what are payday loans? How do they work? In this post, we will explain.

Credit: www.pewtrusts.org

What is a Payday Loan?

A payday loan is a short-term loan. You borrow a small amount of money. You repay it when you get your next paycheck. These loans are usually for emergencies.

Features Of Payday Loans

- Small amounts, usually $100 to $1,000.

- Short repayment period, often two weeks.

- High interest rates and fees.

How to Get a Payday Loan

Getting a payday loan is simple. Here are the steps:

1. Find A Lender

First, find a payday lender. You can search online or in your local area. Make sure the lender is trustworthy.

2. Apply For The Loan

Next, fill out an application. You will need to provide some information. This includes:

- Your name and address.

- Proof of income, like a paycheck stub.

- Your bank account information.

3. Get Approved

The lender will review your application. If approved, you will get the money. This can happen the same day or the next day.

4. Repay The Loan

You must repay the loan on your next payday. The lender will take the money from your bank account. Make sure you have enough money in your account.

Credit: www.incharge.org

Benefits of Payday Loans

Payday loans can help in emergencies. Here are some benefits:

1. Quick Access To Money

You can get money quickly. This is helpful if you have an urgent need.

2. Easy To Qualify

Many people can qualify for a payday loan. You do not need a high credit score.

3. Simple Process

The process is straightforward. You can apply and get approved quickly.

Risks of Payday Loans

Payday loans can also have risks. It is important to understand these risks:

1. High Interest Rates

Payday loans have high interest rates. You may end up paying much more than you borrowed.

2. Short Repayment Period

You must repay the loan quickly. This can be hard if you have other expenses.

3. Debt Cycle

Some people get stuck in a cycle of debt. They take out more loans to repay the first loan.

Alternatives to Payday Loans

If you need money, consider other options. Here are some alternatives:

1. Personal Loans

You can apply for a personal loan from a bank. These loans often have lower interest rates.

2. Borrow From Family Or Friends

Ask your family or friends for help. They may lend you money without interest.

3. Credit Cards

You can use a credit card for emergencies. Be careful of high interest rates.

Frequently Asked Questions

What Are Payday Loans?

Payday loans are short-term, high-interest loans meant for emergency expenses.

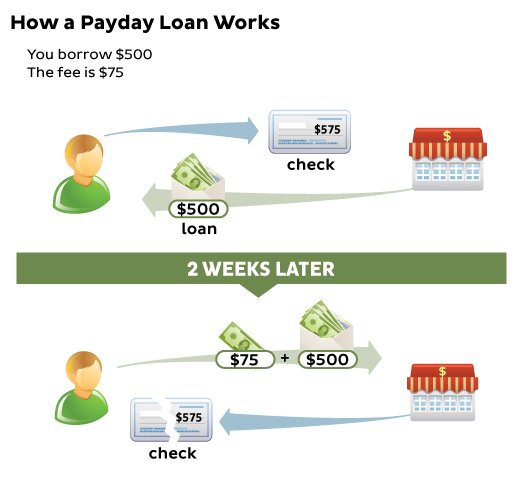

How Do Payday Loans Work?

You borrow a small amount and repay it on your next payday.

Who Can Apply For Payday Loans?

Anyone with a steady income and a bank account can apply.

What Is The Interest Rate On Payday Loans?

Interest rates are high, often exceeding 300% APR.

Conclusion

Payday loans can help in emergencies. But they have risks. Understand how they work before you decide. Consider other options if possible. Make the best choice for your situation.