What Are Payday Loans?

Payday loans are short-term loans. They help you until your next paycheck. You can get these loans quickly. But you must pay them back fast.

Why Choose Payday Loans?

Sometimes, you need money right away. Maybe your car broke down. Maybe you have a medical bill. Payday loans can help in these times.

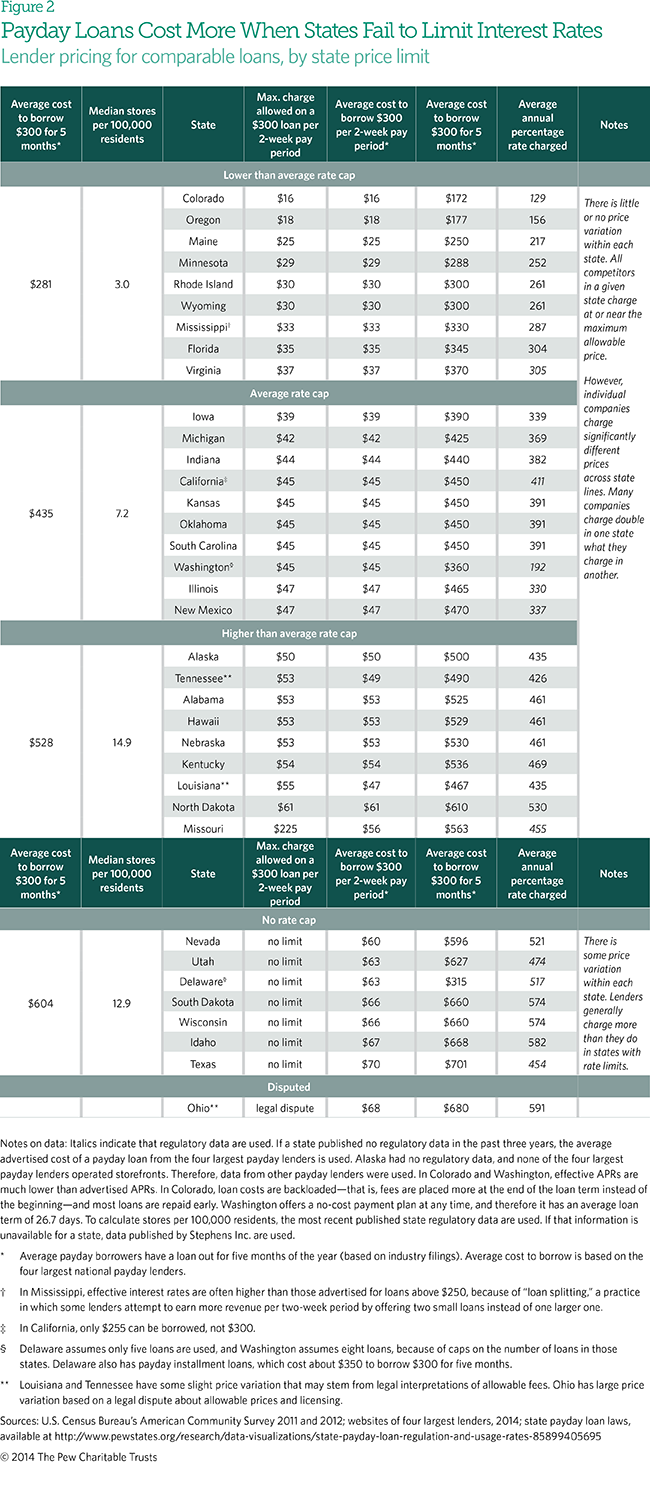

Interest Rates on Payday Loans

Interest rates are the cost of borrowing money. Payday loans often have high rates. But, you can find lower rates if you look.

How to Find the Lowest Interest Rates

Finding the lowest rates is important. Here are some tips:

- Compare different lenders

- Check online reviews

- Look for discounts or special offers

Benefits of Low Interest Rates

Low interest rates mean you pay less. This saves you money. It also makes it easier to pay back the loan.

How to Apply for Payday Loans

Applying for payday loans is simple. Here are the steps:

- Fill out an application form

- Provide proof of income

- Submit your application

Things to Watch Out For

Payday loans can be helpful. But, be careful. Watch out for these things:

- Hidden fees

- High interest rates

- Short repayment terms

Comparing Different Lenders

Different lenders offer different rates. Compare them to find the best deal. Look at:

- Interest rates

- Fees

- Repayment terms

Online Lenders vs. Traditional Lenders

You can get payday loans from online lenders. You can also go to traditional lenders. Both have pros and cons.

| Online Lenders | Traditional Lenders |

|---|---|

| Quick and easy application | Face-to-face interaction |

| Can compare many lenders online | May offer personal advice |

| Funds deposited directly to your account | May take longer to process |

Repaying Your Payday Loan

Payday loans must be repaid quickly. Usually within 14 days. Make sure you have a plan to repay on time.

Tips for Repaying Loans

Here are some tips to help you repay your loan:

- Budget your money

- Set reminders for due dates

- Pay more than the minimum if you can

Credit: www.incharge.org

:max_bytes(150000):strip_icc()/dotdash-title-loans-vs-payday-loans-which-are-better-Final-a61111fe80ff4f4f9a9b0eb9428ba803.jpg)

Credit: www.investopedia.com

Alternatives to Payday Loans

Payday loans are not the only option. Here are some alternatives:

- Personal loans

- Credit cards

- Borrowing from friends or family

Frequently Asked Questions

What Are Payday Loans?

Payday loans are short-term, high-interest loans. Borrowers typically repay them on their next payday.

How Do Payday Loans Work?

Borrowers receive a small amount of money. They must repay it, plus interest, by their next paycheck.

Why Choose Payday Loans With Low Interest Rates?

Lower interest rates mean less money paid back. It helps reduce the total cost of the loan.

Who Qualifies For Payday Loans?

Most people with a steady income and a bank account can qualify. Lenders may have specific criteria.

Conclusion

Payday loans can be a quick fix. But, they come with high interest rates. Finding the lowest rates can save you money. Always compare lenders and read the fine print. Plan to repay your loan on time to avoid extra fees. Consider other options if possible. Use payday loans wisely.