Payday loans are short-term loans. These loans help people who need money fast. In the USA, payday loan laws vary. Each state has its own rules. Some states have strict rules. Others have fewer rules. This article will explain these laws.

What is a Payday Loan?

A payday loan is a small loan. People often use it for emergencies. The loan is due on the borrower’s next payday. This is why it is called a payday loan. The loan amount is usually small. Most payday loans are $500 or less.

Why do People Use Payday Loans?

- Quick access to cash

- No credit check needed

- Easy to apply

People use payday loans when they need money fast. These loans are easy to get. Many people use them to pay for emergencies. For example, car repairs or medical bills.

Payday Loan Laws in the USA

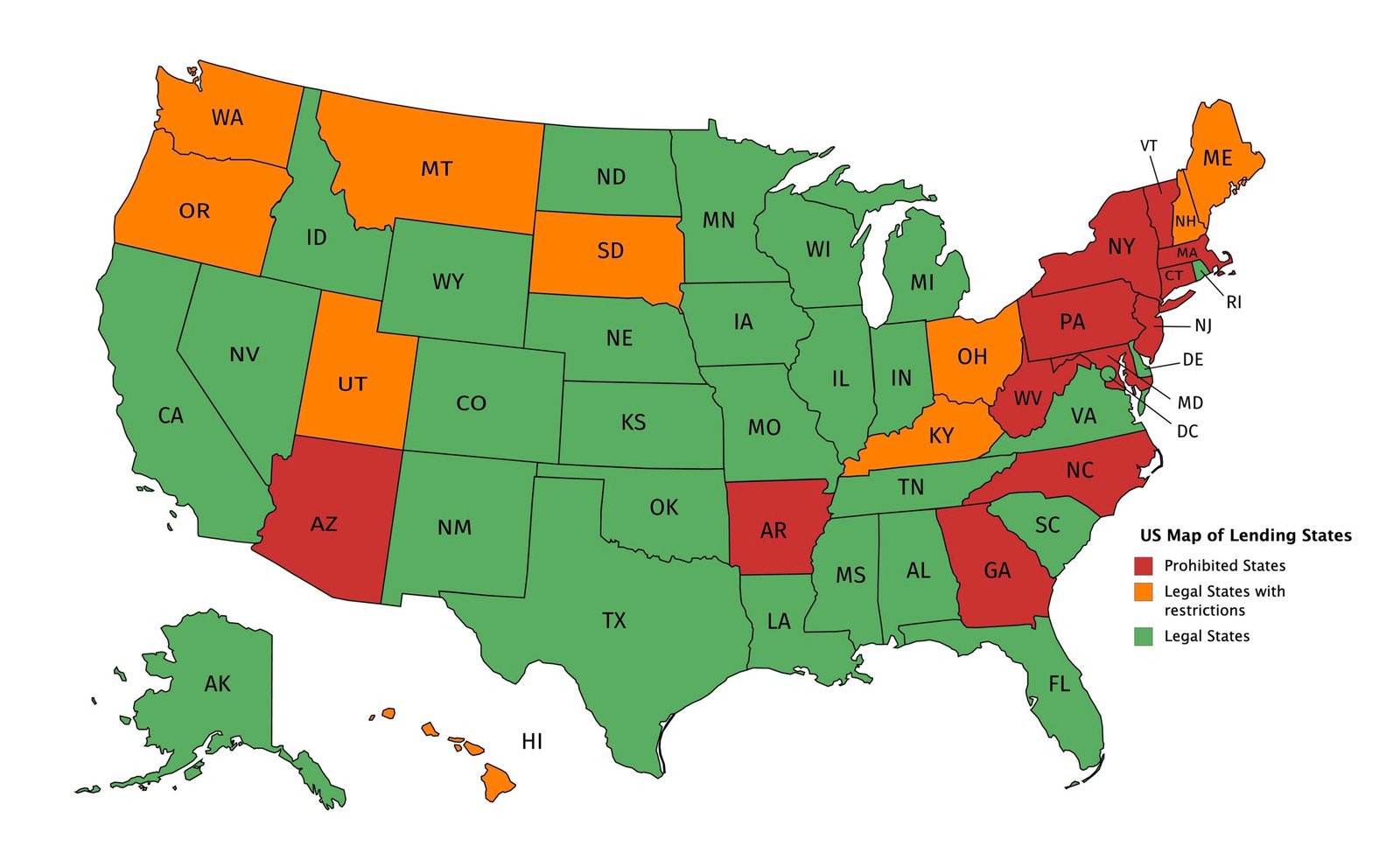

The laws for payday loans are different in each state. Some states have strict laws. Other states have fewer rules. Here are some key points:

Interest Rates

Interest rates for payday loans are high. Some states limit the interest rate. Others do not. This means the cost of the loan can be very high.

Loan Amount Limits

Some states limit the amount of money you can borrow. For example, in California, the limit is $300. In other states, there is no limit.

Loan Term Limits

The term of a payday loan is usually short. Some states limit the term to 14 days. Other states allow longer terms.

Number Of Loans

Some states limit the number of payday loans you can have. For example, in Washington, you can only have eight loans per year. Other states do not have this limit.

Rollovers

A rollover is when you extend the loan term. Some states do not allow rollovers. Other states allow one or more rollovers.

Consumer Protections

Many states have laws to protect consumers. These laws can include:

- Limits on fees

- Limits on interest rates

- Requirements for lenders to be licensed

States with Strict Payday Loan Laws

Some states have strict payday loan laws. These states have many rules to protect consumers. Here are a few examples:

New York

In New York, payday loans are not allowed. This means lenders cannot offer payday loans to people in New York.

Georgia

Georgia also has strict laws. Payday loans are not allowed in Georgia.

North Carolina

In North Carolina, payday loans are not allowed. Lenders cannot offer payday loans in this state.

States with Fewer Payday Loan Laws

Some states have fewer payday loan laws. These states have less protection for consumers. Here are a few examples:

Texas

In Texas, payday loans are allowed. There are few limits on interest rates. This means the cost of a payday loan can be very high.

Utah

Utah also has few limits on payday loans. Interest rates can be very high. There are few rules to protect consumers.

Federal Payday Loan Laws

There are also federal laws for payday loans. These laws apply to all states. One important law is the Military Lending Act (MLA).

Military Lending Act (mla)

The MLA protects active-duty military members. It limits the interest rates for payday loans. The maximum interest rate is 36%. This law also applies to family members of military members.

Credit: en.wikipedia.org

How to Avoid Payday Loan Problems

Payday loans can be expensive. It is important to understand the laws in your state. Here are some tips to avoid problems:

- Know the laws in your state

- Read the loan agreement carefully

- Ask questions if you do not understand

- Consider other options for borrowing money

Credit: www.pewtrusts.org

Other Options for Borrowing Money

There are other options for borrowing money. These options can be cheaper than payday loans. Here are a few examples:

Personal Loans

Personal loans can be a good option. They often have lower interest rates. You can borrow more money with a personal loan.

Credit Cards

Credit cards can also be a good option. They can have lower interest rates than payday loans. Be sure to pay off the balance quickly.

Borrowing From Friends Or Family

Borrowing from friends or family can be a good option. There may be no interest or fees. Be sure to pay them back on time.

Frequently Asked Questions

What Are Payday Loan Laws?

Payday loan laws vary by state. They regulate interest rates, fees, and loan terms.

Are Payday Loans Legal In All States?

No, payday loans are not legal in all states. Some states have banned them.

How Much Can I Borrow With A Payday Loan?

Payday loan amounts depend on state laws. Typically, limits range from $100 to $1,000.

What Is The Maximum Interest Rate For Payday Loans?

Interest rates for payday loans are set by state laws. They can be very high, often over 300%.

Conclusion

Payday loans can be helpful in emergencies. However, they can also be expensive. It is important to understand the laws in your state. Be sure to read the loan agreement carefully. Consider other options for borrowing money. This will help you avoid problems with payday loans.