Refinancing a loan can help you save money. This article will explain how refinancing works. We’ll also discuss when it is a good idea.

What is Refinancing?

Refinancing means taking a new loan to replace an old one. The new loan should have a better interest rate. This way, you pay less money over time.

How Refinancing Works

Here are the steps:

- Find a new loan with a lower interest rate.

- Apply for the new loan.

- Use the new loan to pay off the old loan.

It’s that simple. But there is more to consider.

Why Refinance a Loan?

There are many reasons to refinance. Here are a few:

- Lower interest rates: Save money by paying less interest.

- Better loan terms: Get better conditions, like longer time to pay.

- Improved credit score: If your credit score has improved, you may get a better rate.

These reasons can help you save money. Let’s look at each one in detail.

Lower Interest Rates

Interest is the money you pay to borrow money. If the interest rate is lower, you pay less. For example:

| Old Loan | New Loan |

|---|---|

| 5% interest | 3% interest |

With the new loan, you save 2% on interest.

Better Loan Terms

Loan terms are the conditions of the loan. These include how long you have to pay it back. Longer terms mean smaller monthly payments. Here is an example:

| Old Loan | New Loan |

|---|---|

| 5 years to pay | 10 years to pay |

With the new loan, you have more time to pay. This can make monthly payments easier.

Improved Credit Score

Your credit score is a number that shows how well you handle money. A higher score means you are good with money. If your score goes up, you may get a better loan. For example:

| Old Credit Score | New Credit Score |

|---|---|

| 600 | 700 |

A higher score can help you get a lower interest rate.

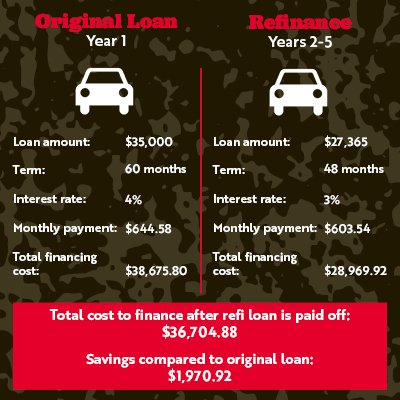

Credit: www.physiciansidegigs.com

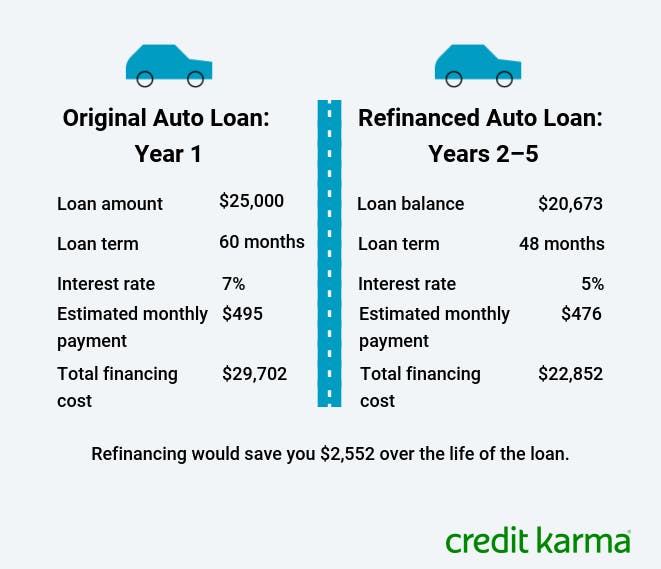

Credit: www.creditkarma.com

When to Refinance

Refinancing is not always a good idea. Here are some times when it can help:

Interest Rates Have Dropped

If interest rates are lower than when you got your loan, it might be a good idea to refinance. Check current rates and compare them to your loan rate. If the new rate is much lower, you can save money.

Your Credit Score Has Improved

If your credit score has gone up, you may get a better loan. Check your score before applying for a new loan. A higher score can help you get lower interest rates.

You Need Lower Payments

If money is tight, you might need lower payments. Refinancing to a longer-term loan can help. This way, you have more time to pay the loan back. Your monthly payments will be smaller.

When Not to Refinance

Refinancing is not always the best choice. Here are some times when it is not a good idea:

High Fees

Some loans have high fees for refinancing. Check the fees before you apply. If the fees are too high, you might not save money.

Short Time Left On Loan

If you are close to paying off your loan, it might not be worth it to refinance. The costs of refinancing might be more than the savings.

Bad Credit

If your credit score is low, you might not get a better loan. Check your score before applying. If it is low, work on improving it first.

How to Refinance

Ready to refinance? Here are the steps:

Check Your Credit Score

First, check your credit score. You can get a free report once a year. A good score can help you get a better loan.

Shop Around

Next, shop around for the best loan. Compare interest rates and loan terms. Look at different lenders to find the best deal.

Apply For The New Loan

Once you find a good loan, apply for it. You will need to provide information about your income and expenses. Be honest and provide all the information they ask for.

Close The Old Loan

If you are approved, use the new loan to pay off the old one. Make sure to close the old loan account. This way, you won’t be charged any more interest on the old loan.

Start Paying The New Loan

Finally, start paying the new loan. Make sure to make your payments on time. This will help you avoid late fees and keep your credit score high.

Frequently Asked Questions

What Is Loan Refinancing?

Refinancing a loan means replacing an old loan with a new one.

Why Should I Refinance My Loan?

You should refinance to get a lower interest rate or better terms.

How Does Refinancing Affect My Credit Score?

Refinancing may cause a small, temporary drop in your credit score.

Can I Refinance Any Type Of Loan?

Yes, you can refinance mortgages, auto loans, and personal loans.

Conclusion

Refinancing a loan can help you save money. It can also give you better loan terms. But it is not always the best choice. Check your credit score and shop around for the best loan. If you find a good deal, refinancing can help you pay less over time.