Applying for a loan is a big step. But sometimes, you need to cancel it. Maybe you found a better deal. Or maybe you no longer need the loan. Whatever the reason, it is possible to cancel a loan application after submission.

This guide will help you understand the steps. Follow these simple steps to cancel your loan application. This will make the process easy and smooth.

Reasons to Cancel a Loan Application

There are many reasons why you might want to cancel a loan application. Here are some common ones:

- You found a better loan offer.

- Your financial situation changed.

- You made a mistake in the application.

- You no longer need the loan.

Whatever your reason, it is important to act fast. The sooner you cancel, the better.

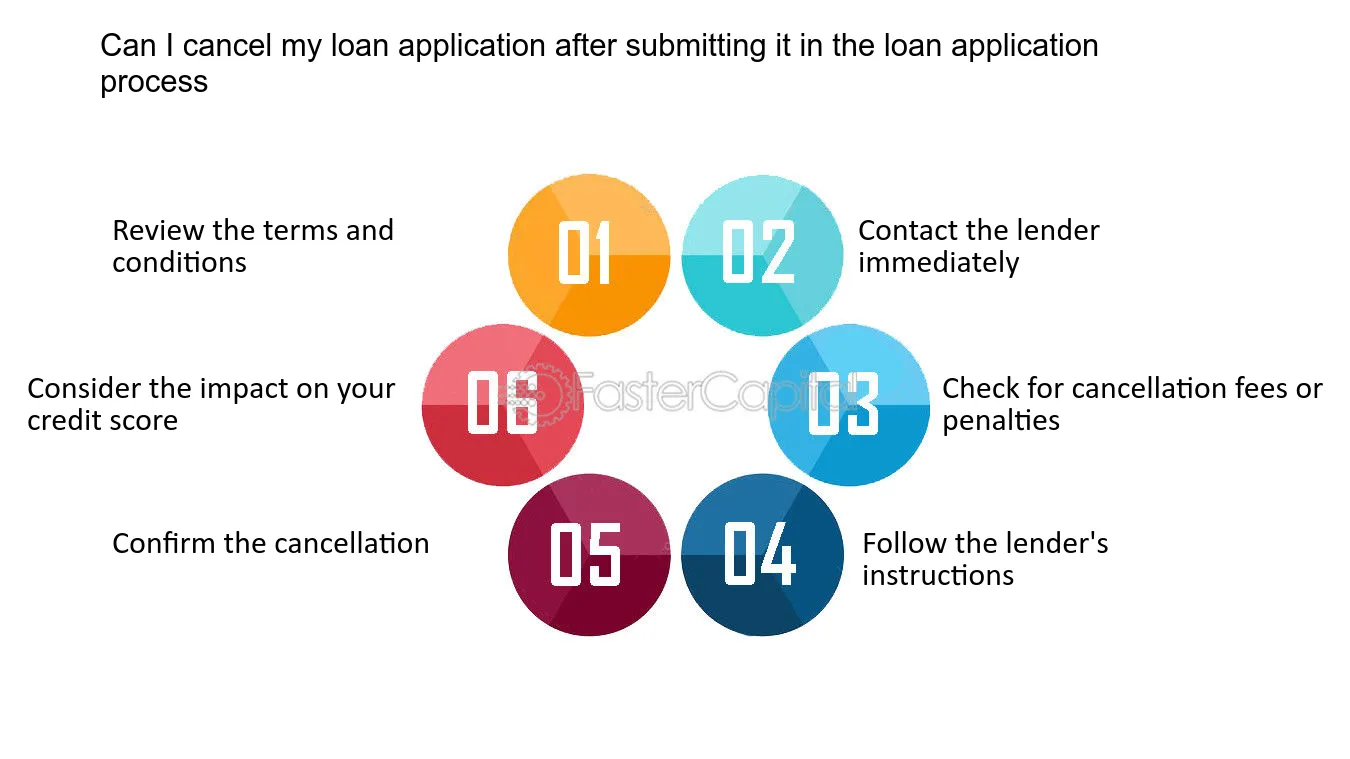

Step-by-Step Guide to Cancel a Loan Application

Here is a simple guide to cancel a loan application:

Step 1: Contact The Lender

The first step is to contact your lender. You can call or email them. Explain that you want to cancel your loan application. Provide your application number if you have it. This will help them find your application quickly.

Step 2: Provide Reason For Cancellation

When you contact the lender, be ready to explain why you want to cancel. You do not need to give a detailed explanation. A simple reason is enough. This helps the lender understand your decision. It also makes the process smoother.

Step 3: Follow Lender’s Instructions

The lender will give you instructions on how to cancel your application. Follow these instructions carefully. They might ask you to send a written request. Or they might ask you to fill out a form. Do what they ask to ensure your application is canceled.

Step 4: Confirm The Cancellation

After you have followed the instructions, confirm the cancellation. Ask the lender to send you a confirmation. This can be an email or a letter. Keep this confirmation for your records. It is proof that you canceled the application.

Credit: savii.my.site.com

What to Do After Canceling a Loan Application

After you cancel your loan application, there are a few things you should do:

- Check your credit report. Make sure the loan application is marked as canceled.

- Look for other loan options if you still need a loan.

- Keep an eye on your credit score. Multiple loan applications can affect your score.

It is important to stay organized. Keep all documents related to the cancellation in a safe place. You might need them in the future.

Credit: edubase.ng

Tips for a Smooth Cancellation Process

Here are some tips to make the cancellation process smooth:

- Act quickly. The sooner you cancel, the easier it will be.

- Be clear and polite when contacting the lender.

- Follow the lender’s instructions carefully.

- Keep records of all communications with the lender.

These tips will help you cancel your loan application without any hassle.

Understanding Loan Application Status

It is helpful to understand the status of your loan application. This will help you know when to act. Here are common statuses you might see:

| Status | Meaning |

|---|---|

| Submitted | Your application is received but not yet reviewed. |

| In Review | Your application is being reviewed by the lender. |

| Approved | Your application is approved and funds are ready. |

| Disbursed | Funds are transferred to your account. |

It is best to cancel your application before it is approved. Once approved, cancellation becomes harder. If funds are disbursed, you may need to return the money. This can complicate things.

Common Questions About Canceling a Loan Application

Here are answers to some common questions:

Can I Cancel A Loan Application After It Is Approved?

Yes, but it is harder. Contact your lender right away. Follow their instructions.

Will Canceling A Loan Application Affect My Credit Score?

It can, but usually not much. Multiple loan applications can lower your score. Canceling one application will not have a big impact.

Can I Reapply For The Same Loan Later?

Yes, you can. But check with the lender. Some lenders may have waiting periods.

Frequently Asked Questions

How Can I Cancel A Loan Application?

You can cancel a loan application by contacting the lender directly.

Is There A Fee To Cancel A Loan Application?

No, most lenders do not charge a fee to cancel an application.

Can I Cancel A Loan Application Online?

Yes, many lenders allow you to cancel applications online through their website.

How Long Does It Take To Cancel A Loan?

It usually takes 1-3 business days to process the cancellation.

Conclusion

Cancelling a loan application is possible and often simple. Contact your lender, give a reason, follow instructions, and confirm the cancellation. Always act quickly and keep records. This will make the process smooth and easy.

Understanding why you want to cancel helps. Being clear and polite in your communication helps too. Follow these steps and tips. You will be able to cancel your loan application without any trouble.