Understanding how global markets affect loan availability is crucial. The world is interconnected. Events in one country can impact another. This is especially true for loans.

What Are Global Markets?

Global markets refer to the international exchange of goods, services, and capital. They include stock markets, currency exchange markets, and commodity markets. They play a big role in the global economy.

Credit: reports.valuates.com

Impact of Global Markets on Loan Availability

Global markets influence loan availability in many ways. Let’s explore some key factors.

Interest Rates

Interest rates are affected by global markets. When global interest rates rise, local banks may also raise their rates. This makes loans more expensive. On the other hand, if global interest rates fall, local banks may lower their rates. This makes loans cheaper.

Economic Stability

Economic stability is important. If a country is stable, banks are more likely to lend. If a country is unstable, banks may be cautious. This can make loans harder to get.

Inflation

Inflation affects loan availability. When inflation is high, the cost of goods and services rises. This can make it harder for people to repay loans. Banks may be less willing to lend during high inflation.

Currency Exchange Rates

Currency exchange rates play a role. If a country’s currency is strong, it can borrow money cheaply from other countries. If the currency is weak, borrowing becomes expensive. This affects loan availability.

Trade Policies

Trade policies impact global markets. When trade is free, economies grow. This can make loans more available. When trade is restricted, economies may shrink. This can make loans less available.

How Banks Respond

Banks respond to global market changes. They adjust their lending practices based on economic conditions. Let’s look at some ways banks respond.

Changing Loan Requirements

Banks may change their loan requirements. They may ask for higher credit scores or more collateral. This helps protect the bank from risk.

Adjusting Interest Rates

Banks adjust interest rates based on global markets. If global rates rise, local rates may also rise. If global rates fall, local rates may fall.

Offering Different Loan Products

Banks may offer different loan products. They may offer fixed-rate loans or adjustable-rate loans. They may offer short-term or long-term loans. This gives borrowers more options.

Impact on Consumers

Global markets affect consumers. Let’s explore how.

Loan Accessibility

Loan accessibility can change. When global markets are strong, loans are easier to get. When global markets are weak, loans may be harder to get.

Loan Costs

Loan costs can change. When global interest rates are low, loans are cheaper. When global interest rates are high, loans are more expensive.

Repayment Terms

Repayment terms can change. Banks may offer flexible repayment plans during good times. During bad times, repayment terms may be stricter.

Financial Planning

Consumers need to plan their finances carefully. They should consider how global markets may affect their loans. They should be prepared for changes.

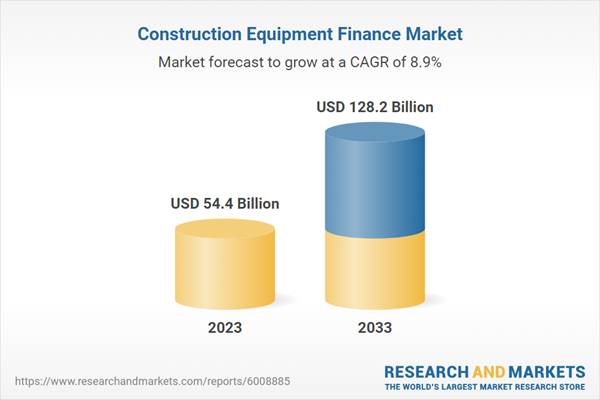

Credit: www.globenewswire.com

Frequently Asked Questions

How Do Global Markets Impact Loan Availability?

Global markets affect interest rates and liquidity, influencing how easy it is to get loans.

Why Do Global Economic Changes Affect Loan Rates?

Economic changes can alter interest rates. These shifts impact how banks set loan rates.

Can A Global Recession Limit Loan Access?

Yes, a global recession can reduce banks’ willingness to lend money.

Do Global Market Trends Affect Mortgage Loans?

Yes, market trends can impact mortgage rates, affecting affordability and availability.

Conclusion

Global markets have a big impact on loan availability. They affect interest rates, economic stability, inflation, currency exchange rates, and trade policies. Banks respond by adjusting their lending practices. Consumers need to be aware of these changes. Understanding these factors can help consumers make informed decisions.