Are you thinking of getting a business loan? You need to check if you qualify first. Knowing your eligibility can save time. It can also help you understand what to expect. This guide will help you. It is easy to follow. Let’s get started.

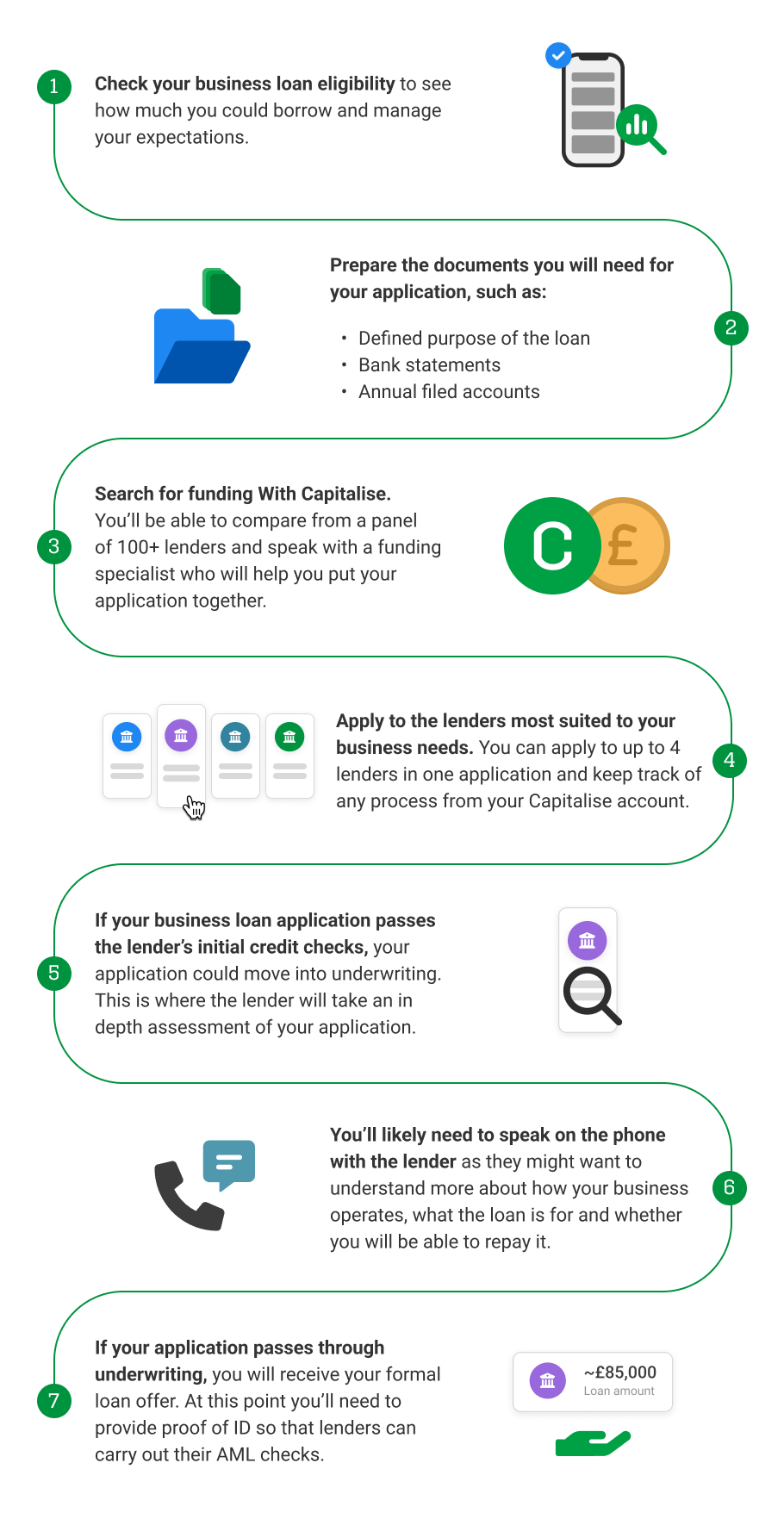

Credit: capitalise.com

Why Check Loan Eligibility?

Checking your eligibility is important. It helps you know if you can get a loan. It also tells you how much you can borrow. This way, you can plan better. You will know what is possible and what is not.

Basic Requirements

Most lenders have basic requirements. These are things you need to meet before they consider your application. Let’s look at some common requirements.

1. Business Age

How long has your business been running? Most lenders want a business that is at least 1 year old. Some may ask for 2 years. New businesses can find it harder to get loans.

2. Annual Revenue

How much money does your business make each year? Lenders look at your annual revenue. They want to know if you can pay back the loan. Most lenders have a minimum revenue requirement. This can be different for each lender.

3. Credit Score

Your credit score is very important. It shows how well you handle debt. A good credit score makes it easier to get a loan. It can also get you better loan terms. Bad credit can make it harder to get approved.

4. Business Plan

Some lenders want to see a business plan. This helps them understand your business. It shows that you have a plan for the future. A good business plan can improve your chances of getting a loan.

Credit: www.tradeudhaar.com

Steps to Check Your Eligibility

Now that you know the basic requirements, let’s look at the steps you need to follow.

1. Gather Your Documents

You need certain documents to check your eligibility. Here are some common ones:

- Business registration papers

- Financial statements

- Tax returns

- Bank statements

- Credit report

Having these ready will make the process easier.

2. Check Your Credit Score

Your credit score is key. You can check it online. Many websites offer free credit score checks. Knowing your score helps you understand your chances. It also helps you find ways to improve it.

3. Calculate Your Annual Revenue

Know how much your business earns. This is your total income for the year. Lenders use this to see if you can repay the loan. Make sure your numbers are correct.

4. Review Your Business Plan

If you have a business plan, review it. Make sure it is clear and detailed. This will help lenders understand your business better.

5. Contact Lenders

Once you have all your information, contact lenders. Many lenders have online forms. Fill these out and provide the required documents. Some lenders may also have eligibility check tools. Use these to see if you qualify.

Common Mistakes to Avoid

There are some common mistakes people make. Let’s look at a few and how to avoid them.

1. Not Checking Credit Score

Always check your credit score first. This helps you understand your position. It also helps you find ways to improve it.

2. Incomplete Documents

Make sure you have all the required documents. Missing documents can delay your application. It can also lead to rejection.

3. Unrealistic Revenue Estimates

Be honest about your revenue. Lenders will check your numbers. If they find mistakes, it can harm your chances.

4. Ignoring Business Plan

Do not ignore your business plan. A good plan can improve your chances. It shows that you are serious about your business.

Frequently Asked Questions

What Documents Are Needed For A Business Loan?

You need ID proof, address proof, business registration, and financial statements.

How Does Credit Score Affect Loan Eligibility?

A high credit score increases your chances of getting a loan.

Can Startups Get Business Loans?

Yes, startups can get business loans with a solid business plan.

What Is The Minimum Income For A Business Loan?

Minimum income varies by lender but generally around $50,000 annually.

Conclusion

Checking your business loan eligibility is important. It helps you understand your chances. It also helps you prepare better. Follow the steps in this guide. Avoid common mistakes. This will help you get the loan you need. Good luck!