Sometimes, we need money quickly. This is where a payday loan can help. Payday loans are short-term loans. They are designed to help you until your next paycheck. Let’s learn how to apply for one.

Credit: www.experian.com

What is a Payday Loan?

A payday loan is a small, short-term loan. It is usually due on your next payday. These loans can help with emergency expenses. They can also help if you need money fast. But they come with high fees. Be careful when using them.

Steps to Apply for a Payday Loan

Applying for a payday loan is easy. Follow these steps:

1. Find A Lender

First, find a payday loan lender. You can find lenders online or in your local area. Look for a reputable lender. Read reviews and check their website. Make sure they are licensed to operate.

2. Gather Your Information

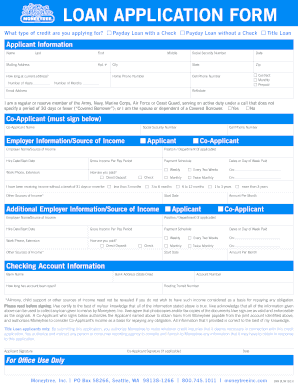

You will need some information to apply. Here is what you usually need:

- Your ID or driver’s license

- Proof of income (like a pay stub)

- Your bank account details

- Your contact information

3. Fill Out The Application

Next, fill out the loan application. You can do this online or in person. Provide all the required information. Make sure it is accurate. Any mistakes can delay your application.

4. Submit The Application

Once the application is complete, submit it. The lender will review it. They will check your information. This usually takes a few minutes to an hour.

5. Get Approved

If your application is approved, you will receive the money. This can be on the same day or the next day. The money will be deposited into your bank account. You can then use it for your needs.

Credit: www.uslegalforms.com

Requirements for a Payday Loan

Not everyone can get a payday loan. There are some requirements you must meet. Here are the common ones:

- You must be at least 18 years old.

- You need a regular source of income.

- You must have a valid ID.

- You need an active bank account.

- You must be a resident of the state where you apply.

Pros and Cons of Payday Loans

Payday loans have advantages and disadvantages. It is important to know both. This will help you make a smart decision.

Pros

- Quick and easy application process

- Funds available quickly

- Can help in emergencies

- No need for a high credit score

Cons

- High fees and interest rates

- Short repayment period

- Can lead to a cycle of debt

- May affect your credit score if not paid on time

Alternatives to Payday Loans

Payday loans are not the only option. There are other ways to get money quickly. Here are some alternatives:

1. Personal Loans

Personal loans have lower interest rates. They have longer repayment periods. You can get them from banks or credit unions.

2. Credit Card Cash Advance

You can use your credit card for a cash advance. The interest rate is higher than regular credit card purchases. But it is lower than payday loans.

3. Borrow From Friends Or Family

This is the safest option. You can borrow money from friends or family. Make sure to pay them back on time.

4. Local Assistance Programs

Some local organizations offer financial help. This can be in the form of grants or low-interest loans.

Tips for Using Payday Loans Wisely

If you decide to get a payday loan, be smart. Here are some tips to use payday loans wisely:

1. Borrow Only What You Need

Do not borrow more than you need. Borrowing too much can lead to more debt.

2. Pay It Back On Time

Make sure to pay back the loan on time. This will help you avoid extra fees and interest.

3. Use It For Emergencies Only

Use payday loans only for emergencies. Do not use them for regular expenses.

4. Understand The Terms And Conditions

Read and understand the loan terms. Know the fees, interest rates, and repayment period. This will help you avoid surprises.

Frequently Asked Questions

What Is A Payday Loan?

A payday loan is a short-term, high-interest loan.

How Do I Apply For A Payday Loan?

You can apply online or at a payday loan store.

What Documents Are Needed For A Payday Loan?

You need ID, proof of income, and a bank account.

Can I Get A Payday Loan With Bad Credit?

Yes, many lenders approve payday loans without credit checks.

Conclusion

Payday loans can be helpful in emergencies. But they come with high costs. It is important to understand the process. Follow the steps and meet the requirements. Know the pros and cons. Consider alternatives if possible. Use payday loans wisely. This will help you manage your finances better.