Changing jobs can be exciting. You might be getting a better salary. Maybe, a better role. But, what if you need a loan during this time? Is it possible to apply for a loan while changing jobs? Let’s find out.

Understanding Loans and Job Stability

Lenders look at many things before giving a loan. One important thing is job stability. They want to see if you can pay back the loan. If you are changing jobs, lenders might worry. They might think you will not have a steady income.

Why Job Stability Matters

Job stability shows that you have a steady income. Lenders feel safe when you have a stable job. They know you can pay back the loan. If you are changing jobs, it creates uncertainty. Lenders might think you won’t have money to pay back.

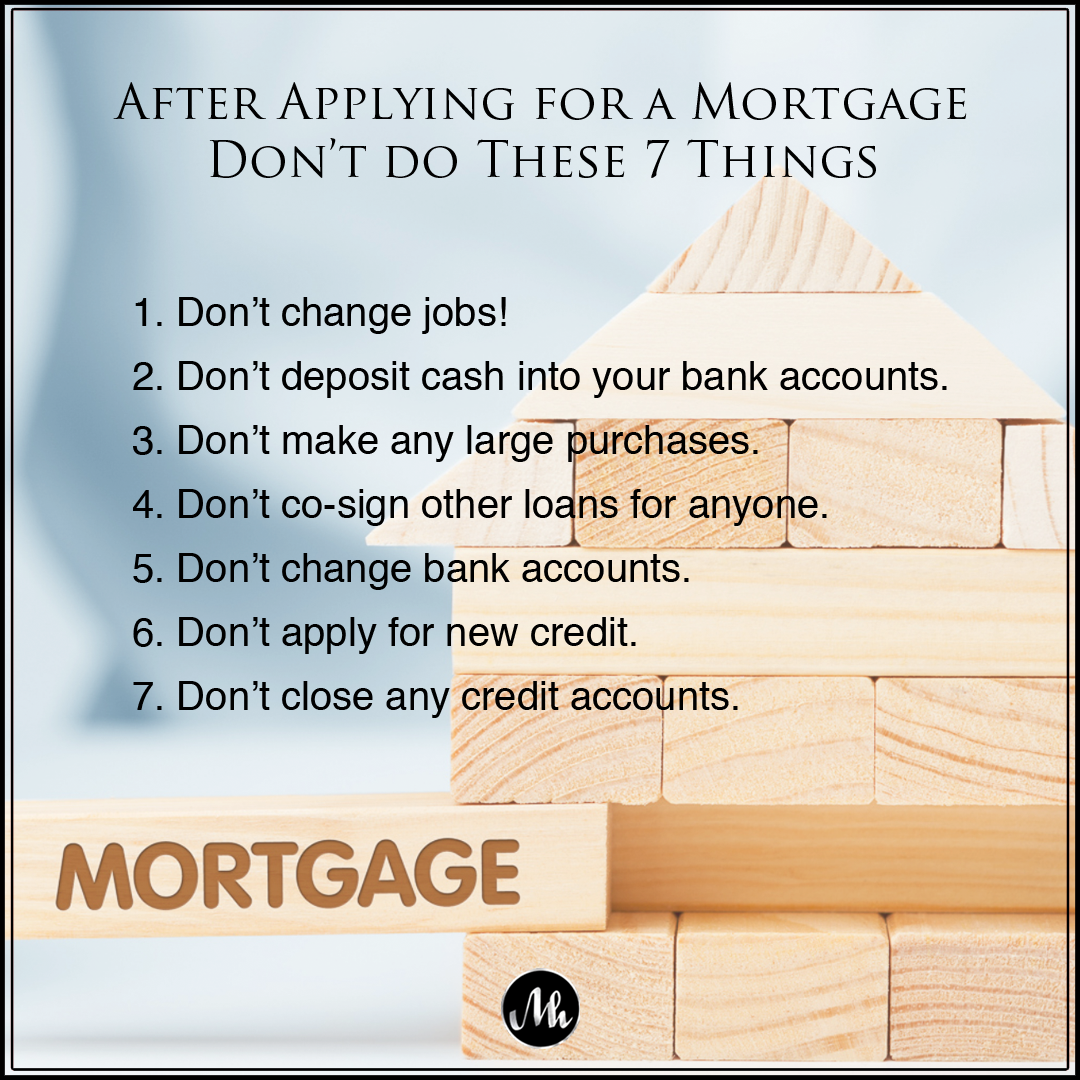

Credit: www.rocketmortgage.com

Types of Loans to Consider

Different loans have different rules. Some loans might be easier to get. Others might be harder. Let’s look at some common loans.

Personal Loans

Personal loans can be used for many things. You can use them for home repairs, medical bills, or even a vacation. Lenders look at your credit score and income. If you are changing jobs, it might be harder to get a personal loan.

Home Loans

Home loans are for buying a house. These loans are big. Lenders look at many things. They check your credit score, income, and job stability. Changing jobs can make it tough to get a home loan. Lenders want to see a steady income for a long time.

Auto Loans

Auto loans are for buying a car. These loans are smaller than home loans. Lenders still look at your income and job stability. Changing jobs might make it harder to get an auto loan. But, it might not be as hard as getting a home loan.

Factors Lenders Consider

Lenders look at many things before giving a loan. Let’s see what they consider.

Credit Score

Your credit score is very important. It shows how well you manage money. A high credit score means you pay back on time. A low score means you have trouble paying back. Lenders like high credit scores.

Debt-to-income Ratio

This ratio shows how much debt you have compared to your income. Lenders want a low ratio. It means you do not have much debt. A high ratio means you have too much debt. Lenders might worry you cannot pay back the loan.

Current Income

Lenders want to know your current income. They want to make sure you can pay back the loan. If you are changing jobs, they might worry about your income. They might want proof of your new job offer.

Employment History

Lenders look at your job history. They like to see that you stay in jobs for a long time. If you change jobs often, lenders might worry. They might think you will not have a steady income.

Steps to Improve Your Chances

Even if you are changing jobs, you can still try to get a loan. Here are some steps to improve your chances.

Get A Job Offer Letter

If you have a new job offer, get it in writing. Show it to the lender. It proves you will have a steady income. It can make the lender feel better.

Improve Your Credit Score

Work on your credit score. Pay off any debts. Make sure to pay bills on time. A high credit score can help you get a loan.

Save Money

Save some money before you apply for a loan. Having savings shows that you are responsible. It can make lenders feel safer.

Keep Old Job Until Loan Is Approved

If possible, stay at your old job until the loan is approved. Lenders like to see job stability. Changing jobs after getting the loan can be easier.

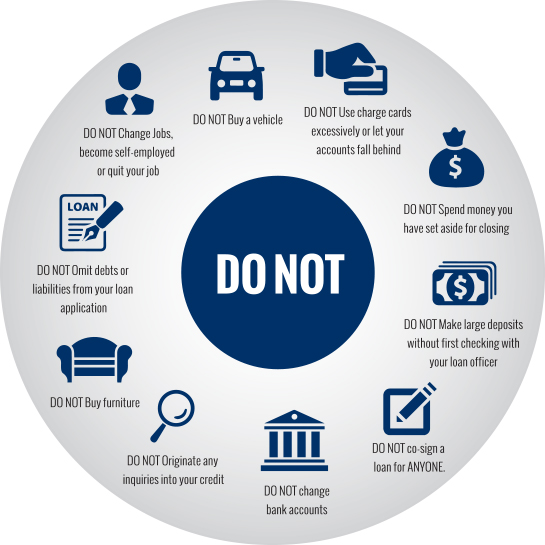

Credit: firsttitlenaples.com

Challenges You Might Face

Changing jobs and applying for a loan can be tough. You might face some challenges.

Higher Interest Rates

Lenders might give you a higher interest rate. They do this if they think you are a risk. A higher interest rate means you pay more money over time.

Loan Denial

Lenders might deny your loan. They might think you are too risky. This can be a big problem if you need the money.

When to Wait

Sometimes, it is better to wait before applying for a loan. Here are some reasons to wait.

New Job Not Confirmed

If your new job is not confirmed, wait. Lenders want proof of steady income. Applying before your job is confirmed can be risky.

Low Credit Score

If you have a low credit score, work on improving it. A higher score can help you get better loan terms. It can also make lenders feel safer.

High Debt

If you have a lot of debt, pay some off first. A lower debt-to-income ratio can help you get a loan. It shows that you manage money well.

Frequently Asked Questions

Can You Get A Loan With A New Job?

Yes, you can. Lenders check your income stability.

Will Changing Jobs Affect My Loan Approval?

It might. Lenders prefer steady employment history.

How Long Should I Wait To Apply For A Loan After A Job Change?

Wait at least 3 months. It shows stability.

Do Lenders Verify Employment When You Apply For A Loan?

Yes, lenders verify your current job and income.

Conclusion

Changing jobs can make getting a loan tricky. But, it is not impossible. Understand what lenders look for. Improve your credit score. Save money. Get a job offer letter. Stay at your old job until the loan is approved. These steps can help you get the loan you need.

Always remember, be honest with your lender. Show them you are responsible. You can get a loan, even when changing jobs.