Getting a loan is a big decision. It can help you buy a home, car, or pay for school. But choosing the wrong loan can be costly. Here are some common mistakes people make when comparing loan offers.

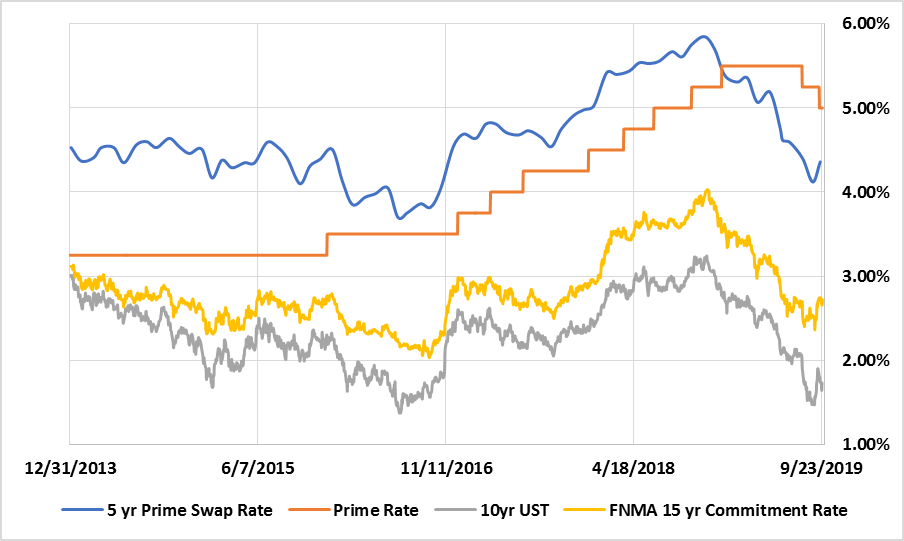

Not Checking the Interest Rate

Interest rates are important. They tell you how much you will pay over time. A high rate means you pay more money. Always compare the interest rates of different loans. A small difference can cost you a lot.

Ignoring Fees and Charges

Loans come with fees. Some common fees are processing fees, late fees, and prepayment charges. These fees add up. They make the loan more expensive. Always check for hidden fees when comparing loans.

Not Understanding the Loan Terms

Loan terms are the rules of the loan. They tell you how long you have to pay. They also tell you what happens if you miss a payment. Make sure you understand the terms of each loan. Don’t pick a loan with terms you don’t understand.

Focusing Only on Monthly Payments

Many people look at the monthly payment first. They pick the loan with the lowest payment. But this can be a mistake. A low payment might mean a longer loan. This means you pay more interest over time. Look at the total cost of the loan, not just the monthly payment.

Not Checking Your Credit Score

Credit scores are important for loans. A high score can get you a lower interest rate. Check your credit score before you apply for a loan. If your score is low, try to improve it first.

Not Comparing Enough Offers

Don’t choose the first loan you see. Compare offers from different lenders. This will help you find the best deal. Use online tools to compare loans. The more offers you compare, the better your choice will be.

Overlooking the Loan Type

There are different types of loans. Some are better for buying a home. Others are good for paying for school. Make sure you choose the right type of loan. A wrong loan type can cost you more money.

Credit: www.westernsouthern.com

Not Reading the Fine Print

Always read the fine print. It contains important information about the loan. It tells you about fees, terms, and conditions. Don’t skip this step. Understanding the fine print can save you money.

Not Considering the Lender’s Reputation

Not all lenders are the same. Some have better customer service. Others have hidden fees. Check the lender’s reputation before you choose a loan. Read reviews and ask for recommendations. A good lender can make the loan process easier.

Credit: www.tayloradvisor.com

Ignoring the Impact of Loan Duration

The length of your loan matters. A longer loan means lower monthly payments. But it also means more interest over time. A shorter loan means higher payments but less interest. Consider the impact of the loan duration on your finances.

Not Asking Questions

Don’t be afraid to ask questions. If you don’t understand something, ask. Lenders should explain everything to you. Asking questions can help you make a better decision.

Frequently Asked Questions

What Are Common Mistakes In Comparing Loan Offers?

People often ignore hidden fees and interest rates.

How Do I Compare Interest Rates Effectively?

Check annual percentage rates (APR). It includes all fees.

Why Should I Consider Loan Terms?

Loan terms affect monthly payments and total cost.

Can Ignoring Fees Cost Me More?

Yes, hidden fees can make loans expensive.

Conclusion

Comparing loan offers can be tricky. But avoiding these mistakes can save you money. Always check the interest rate, fees, and terms. Compare many offers and understand the fine print. A little extra effort can help you find the best loan for your needs.