Sometimes, we all need money quickly. Day loans can help. They are short-term loans. You get the money fast. You must pay it back soon. Let’s learn more about day loans. This guide will explain how they work. It will also discuss when to use them. Finally, we will look at the good and bad sides.

Credit: www.consumerfinance.gov

What are Day Loans?

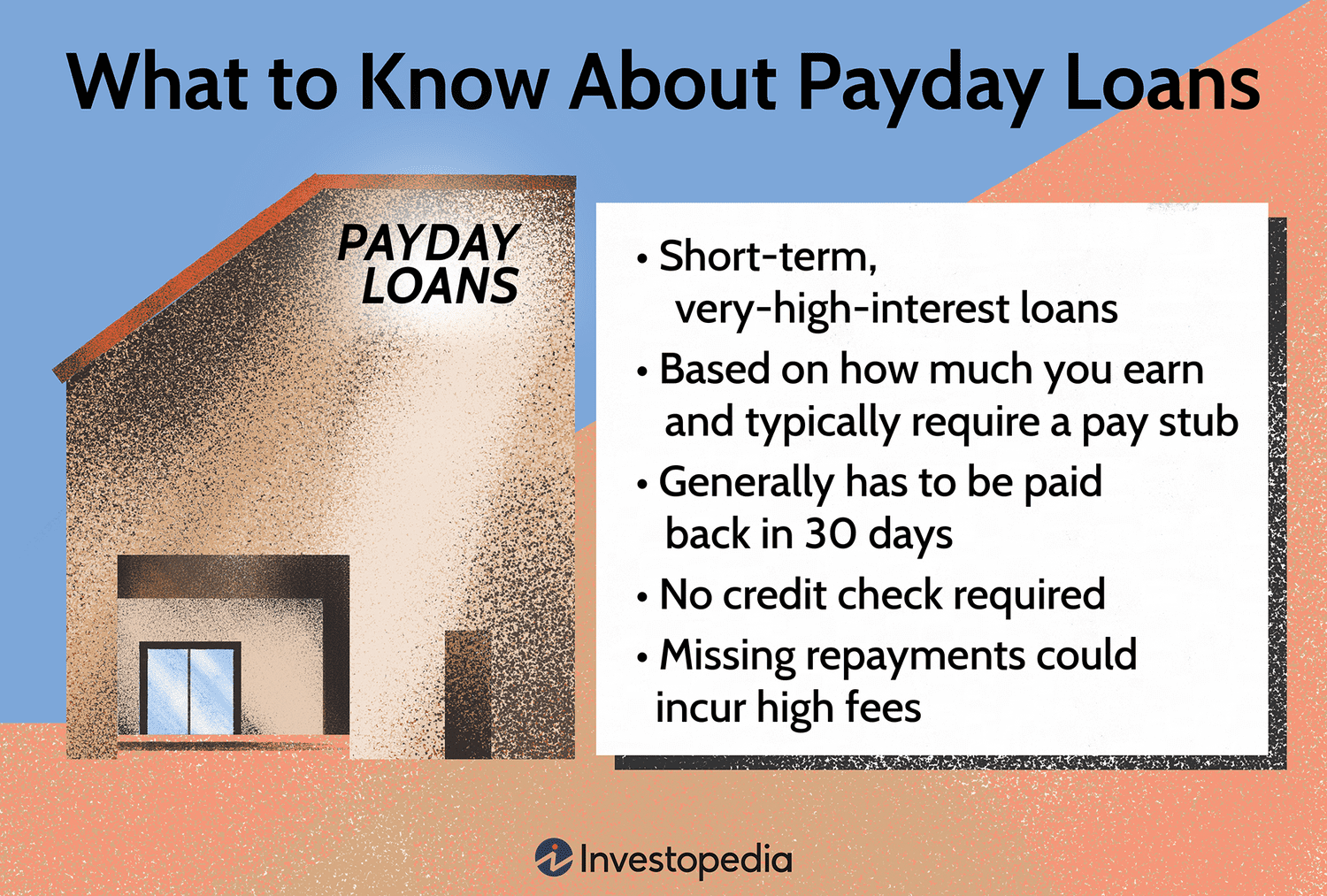

Day loans are short-term loans. You borrow a small amount of money. You pay it back quickly. Usually, you repay within a few weeks. These loans are for emergencies. For example, you need to fix your car. Or, you have a medical bill. Day loans can help.

How Do Day Loans Work?

The process is simple. First, you apply for the loan. You can do this online or in-person. Next, the lender checks your information. They want to see if you can repay the loan. If you are approved, you get the money. This can happen in just one day. Finally, you must pay back the loan. Usually, you pay it back with your next paycheck.

Steps To Get A Day Loan

- Apply for the loan.

- The lender checks your information.

- If approved, you get the money.

- Pay back the loan with your next paycheck.

Credit: theintercept.com

When to Use Day Loans?

Day loans are for emergencies. Here are some examples:

- Car repair

- Medical bill

- Unexpected travel

- Home repair

Use day loans when you need money fast. But, remember, you must pay it back soon. Do not use day loans for everyday expenses. They are not for buying clothes or eating out.

Pros of Day Loans

Day loans have some good points. Let’s look at them:

- Quick Approval: You get the money fast. Sometimes in just one day.

- Easy Process: The application is simple. You can do it online.

- Helps in Emergencies: These loans are for urgent needs.

Cons of Day Loans

Day loans also have some bad points. Here are a few:

- High Interest: You pay a lot of extra money. The interest rates are high.

- Short Repayment Time: You must repay quickly. Usually, in a few weeks.

- Possible Debt Cycle: If you cannot repay, you might need another loan. This can lead to more debt.

Comparing Day Loans With Other Loans

| Type of Loan | Repayment Time | Interest Rate | Purpose |

|---|---|---|---|

| Day Loan | Few weeks | High | Emergencies |

| Personal Loan | 1-5 years | Medium | Large expenses |

| Credit Card | Revolving | Medium-High | Everyday expenses |

Things to Consider Before Taking a Day Loan

Think carefully before you take a day loan. Here are some tips:

- Check the interest rate. Make sure you can afford it.

- Read the terms and conditions. Understand what you are agreeing to.

- Have a plan to repay the loan. Know how you will get the money.

- Consider other options. Maybe a family member can help. Or, try to save some money.

Frequently Asked Questions

What Are Day Loans?

Day loans are short-term loans. They are usually repaid within a day.

How Do Day Loans Work?

Day loans provide quick cash. You must repay the loan within 24 hours.

Are Day Loans Safe?

Yes, but choose a reputable lender. Read the terms carefully.

Can I Get A Day Loan With Bad Credit?

Yes, many lenders offer day loans to people with bad credit.

Conclusion

Day loans can help in emergencies. They are quick and easy to get. But, they have high interest rates. You must repay them quickly. Use day loans wisely. Think about your needs and your ability to repay. Always read the terms and conditions. Make sure you understand what you are agreeing to. If you use them carefully, day loans can be a good tool in tough times.