Buying a car is a big step. For many, it means taking a loan. But, do you need a co-signer for a car loan? Let’s find out.

What is a Co-Signer?

A co-signer is someone who agrees to pay the loan if you can’t. This person helps you get approved for the loan. They also help you get a better interest rate.

When Do You Need a Co-Signer?

Not everyone needs a co-signer. Here are some reasons why you might need one:

- You have a low credit score.

- You have no credit history.

- Your income is too low.

- You have a high debt-to-income ratio.

Low Credit Score

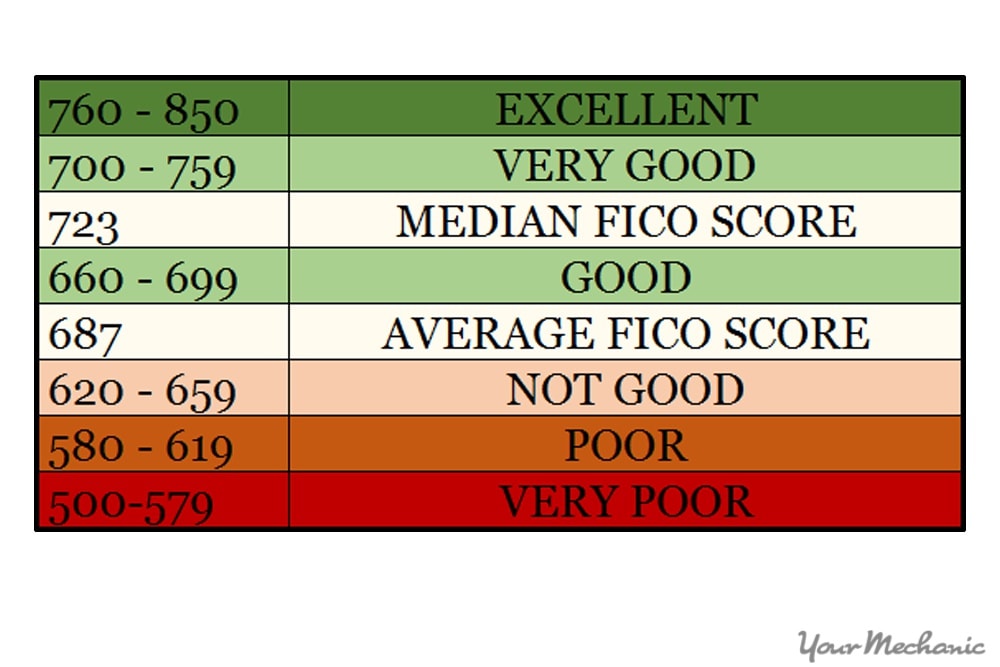

A low credit score can make it hard to get a loan. Lenders see you as a high-risk borrower. A co-signer with a good credit score can help.

No Credit History

If you have no credit history, lenders don’t know if you can pay back the loan. A co-signer with a good history can make lenders feel safe.

Low Income

If your income is low, lenders may think you can’t afford the loan payments. A co-signer with a higher income can help you get approved.

High Debt-to-income Ratio

Your debt-to-income ratio shows how much of your income goes to paying debts. A high ratio means you have a lot of debt. A co-signer can help balance this.

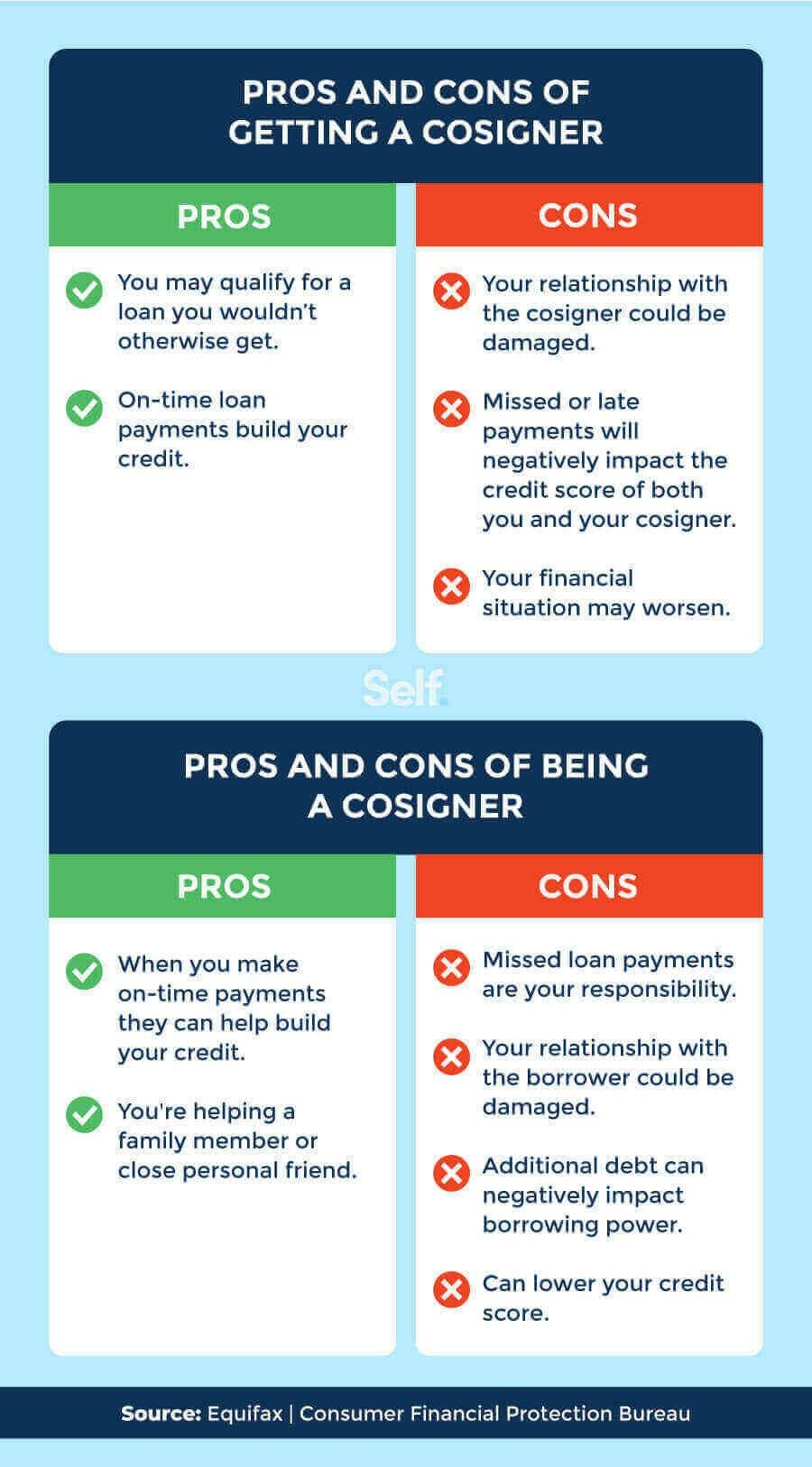

Benefits of Having a Co-Signer

Having a co-signer can be very helpful. Here are some benefits:

- Better chance of getting approved.

- Lower interest rates.

- Build your credit history.

Better Chance Of Getting Approved

A co-signer can make lenders feel more secure. This means you’re more likely to get approved for the loan.

Lower Interest Rates

A co-signer with good credit can help you get a lower interest rate. This means you will pay less over time.

Build Your Credit History

Having a loan in your name can help build your credit history. This is important for future loans and financial needs.

Risks for the Co-Signer

Being a co-signer is a big responsibility. Here are some risks:

- If you don’t pay, the co-signer must pay.

- It can hurt their credit score.

- It can affect their ability to get loans.

If You Don’t Pay

If you can’t make the payments, the co-signer must pay. This can cause stress and financial problems for them.

Impact On Credit Score

If you miss payments, it can hurt the co-signer’s credit score. This can make it harder for them to get loans in the future.

Affecting Their Loan Ability

Being a co-signer means they are responsible for your loan. This can affect their ability to get new loans or credit.

Credit: www.yourmechanic.com

Choosing a Co-Signer

Choosing a co-signer is important. Here are some tips:

- Pick someone with good credit.

- Choose someone who trusts you.

- Make sure they understand the risks.

Good Credit

Choose a co-signer with a good credit score. This will help you get better loan terms.

Trust

Pick someone who trusts you and your ability to pay back the loan. This will make the process smoother.

Understanding The Risks

Make sure your co-signer understands the risks involved. They should know what happens if you can’t make the payments.

Alternatives to a Co-Signer

If you can’t find a co-signer, don’t worry. There are other options:

- Improve your credit score.

- Save for a larger down payment.

- Consider a different lender.

Improve Your Credit Score

Work on improving your credit score. Pay your bills on time and reduce your debts.

Save For A Larger Down Payment

A larger down payment can help you get a loan. It shows lenders you are serious and can afford the car.

Consider A Different Lender

Some lenders specialize in helping people with bad credit. Look for lenders who are willing to work with you.

Credit: www.bankrate.com

Frequently Asked Questions

What Is A Co-signer For A Car Loan?

A co-signer is someone who guarantees your loan repayment.

When Do You Need A Co-signer For A Car Loan?

You need a co-signer if your credit score is low.

Can A Co-signer Help Me Get Better Loan Terms?

Yes, a co-signer with good credit can improve your loan terms.

What Are The Risks For The Co-signer?

The co-signer risks their credit if you don’t pay the loan.

Conclusion

Getting a car loan can be easier with a co-signer. They can help you get approved and get better terms. But, it’s important to understand the risks for them. If you can’t find a co-signer, consider other options. Improve your credit score, save for a larger down payment, or find a lender who can help. Good luck with your car loan journey!