Many people need money quickly. Payday loans can help. But do they help build credit history?

What Are Payday Loans?

Payday loans are short-term loans. You borrow a small amount. You must pay it back by your next payday.

How Payday Loans Work

You apply for a payday loan. If approved, you get the money fast. You must repay the loan in a short time. Usually, this is within two weeks.

Pros Of Payday Loans

- Quick access to money

- Easy to qualify for

- Less paperwork

Cons Of Payday Loans

- High-interest rates

- Short repayment period

- Can lead to debt cycle

Credit History and Credit Score

Your credit history shows how you handle debt. It includes loans, credit cards, and bill payments. Your credit score is a number. It shows if you are good at managing money.

Good Credit Score Benefits

- Lower interest rates

- Better loan offers

- Higher chances of approval

Credit: www.debt.org

Credit: debthammer.org

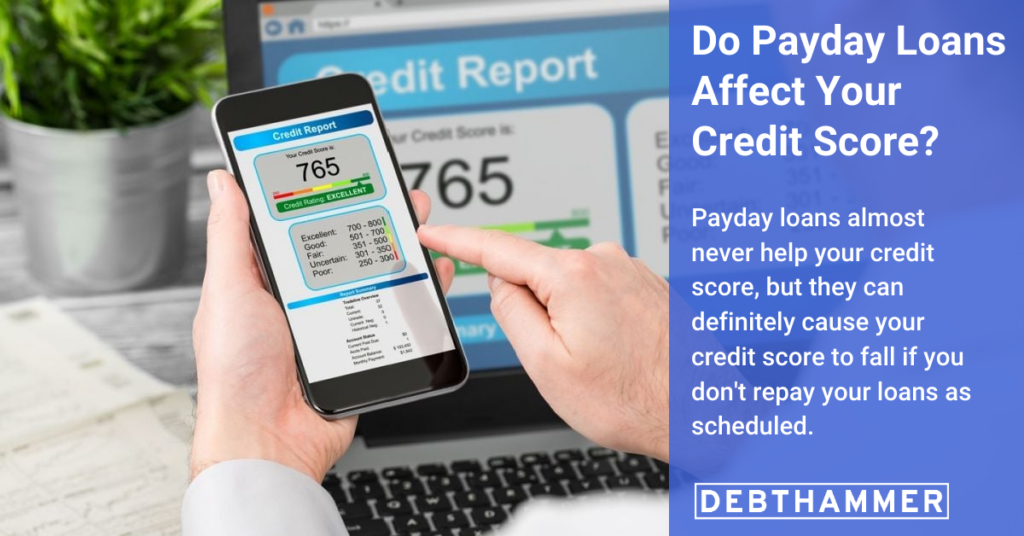

Do Payday Loans Affect Credit History?

Payday loans are not like regular loans. They do not report to the major credit bureaus. So, they do not usually help build credit history.

When Payday Loans Can Affect Credit

But, if you do not repay the loan, it can hurt your credit. The lender can send your debt to a collection agency. This will show up on your credit report. It can lower your credit score.

Alternatives to Payday Loans

There are other ways to get money and build credit. Consider these options:

Credit Cards

Use a credit card for small purchases. Pay the balance in full each month. This helps build credit history.

Personal Loans

Personal loans have lower interest rates than payday loans. They also report to credit bureaus.

Credit Builder Loans

Some banks offer credit builder loans. You borrow a small amount. You make monthly payments. This helps build credit history.

How to Improve Credit Score

You can improve your credit score with good habits. Here are some tips:

Pay Bills On Time

Always pay your bills on time. Late payments hurt your credit score.

Keep Credit Card Balances Low

Do not use too much of your credit limit. Keep balances low to improve your score.

Check Your Credit Report

Check your credit report regularly. Look for mistakes. Dispute any errors you find.

Limit New Credit Applications

Do not apply for too many new credit accounts. Each application can lower your score.

Frequently Asked Questions

Do Payday Loans Affect Credit Score?

Payday loans do not directly affect your credit score unless you default.

Can A Payday Loan Improve Credit History?

Payday loans can improve credit if reported to credit bureaus and paid on time.

Are Payday Loans Reported To Credit Bureaus?

Most payday loans are not reported to major credit bureaus.

Do Payday Loans Show Up On Credit Reports?

Payday loans usually don’t show up on credit reports unless unpaid.

Conclusion

Payday loans can help in emergencies. But they do not help build credit history. Consider other options to build your credit. Use good habits to improve your score.