Choosing the right interest rate is important. It affects how much you pay back. There are two main types of interest rates. These are fixed and floating interest rates. But which should you choose? Let’s explore both options.

What are Fixed Interest Rates?

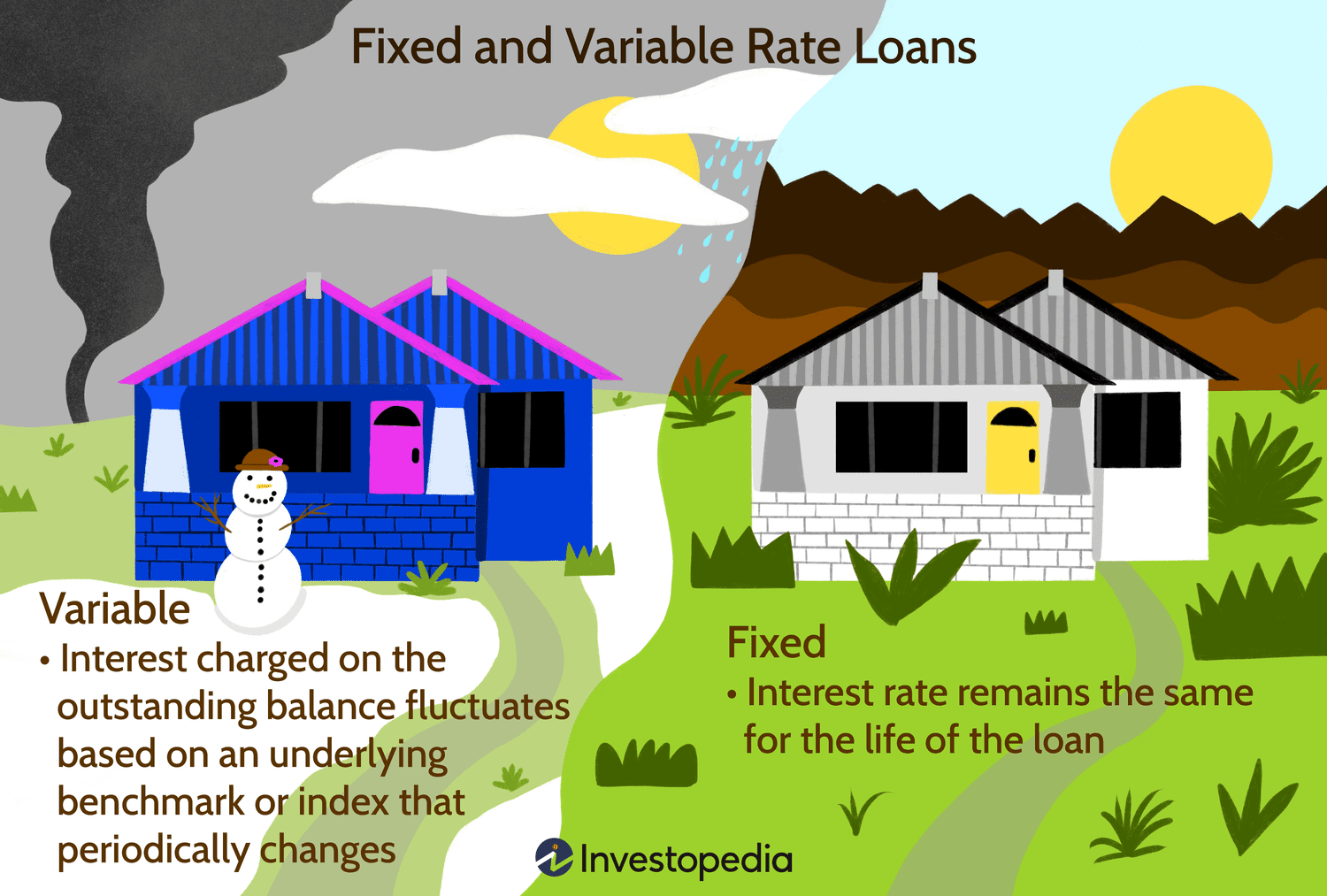

Fixed interest rates do not change. They stay the same for the entire loan period. This means you will pay the same amount every month. Fixed interest rates are easy to understand. They offer stability and predictability.

Advantages of Fixed Interest Rates

There are several benefits to choosing fixed interest rates:

- Predictable Payments: Your monthly payments are the same. This makes budgeting easier.

- No Surprises: You know what to expect. Your interest rate will not increase.

- Peace of Mind: Fixed rates offer stability. You do not have to worry about market changes.

Credit: www.salliemae.com

Disadvantages of Fixed Interest Rates

However, there are also some drawbacks:

- Higher Initial Rates: Fixed interest rates can be higher than floating rates at first.

- No Benefit from Lower Rates: If market rates go down, you will not benefit.

What are Floating Interest Rates?

Floating interest rates change over time. They are also called variable rates. These rates go up and down with the market. Your monthly payments can change. Floating rates depend on the market conditions.

Advantages of Floating Interest Rates

Choosing floating interest rates can be beneficial:

- Lower Initial Rates: Floating rates often start lower than fixed rates.

- Benefit from Lower Rates: If market rates go down, your payments decrease.

Disadvantages of Floating Interest Rates

But there are also some risks:

- Unpredictable Payments: Your payments can change. This makes budgeting harder.

- Risk of Higher Payments: If market rates rise, your payments increase.

Choosing Between Fixed and Floating Interest Rates

Deciding which rate to choose depends on your situation. Here are some things to consider:

Your Budget

Think about your budget. Can you handle changes in your payments? Fixed rates offer stability. Floating rates can change. Choose the one that fits your budget best.

Market Conditions

Look at current market conditions. Are interest rates high or low? If rates are low, a fixed rate may be better. If rates are high, a floating rate might save you money.

Loan Term

Consider how long you will have the loan. For short-term loans, floating rates may be better. For long-term loans, fixed rates offer more stability.

Risk Tolerance

Think about your risk tolerance. Do you prefer stability? Fixed rates are a safe choice. Are you willing to take risks? Floating rates might save you money.

:max_bytes(150000):strip_icc()/floatinginterestrate.asp-final-e149f1f9350543248c58a74e2f9ad3c5.png)

Credit: www.investopedia.com

Examples of Fixed and Floating Rates

Let’s look at some examples. These will help you understand better.

| Type | Example |

|---|---|

| Fixed Rate | 10-year loan with 5% interest rate. Monthly payment stays the same. |

| Floating Rate | 10-year loan with interest rate starting at 4%. Rate can change with the market. |

Frequently Asked Questions

What Is A Fixed Interest Rate?

A fixed interest rate stays the same throughout the loan term.

What Is A Floating Interest Rate?

A floating interest rate changes based on the market conditions.

Which Interest Rate Is Better For A Long-term Loan?

Fixed rates are often better for long-term loans due to stability.

Are Floating Rates Cheaper Than Fixed Rates?

Floating rates can be cheaper initially but may increase over time.

Conclusion

Both fixed and floating interest rates have their pros and cons. Fixed rates offer stability. Floating rates can save you money. Your choice depends on your budget, market conditions, loan term, and risk tolerance. Take time to consider your options. Make the best choice for your needs.

Remember, understanding your loan terms is important. This will help you make informed decisions. Choose wisely and manage your finances well.