Payday loans are short-term loans. They help people get quick cash. But how many payday loans can you have at once? This is an important question. Let’s explore this topic.

Credit: www.pewtrusts.org

Understanding Payday Loans

Payday loans are small loans. You must pay them back quickly. Usually, by your next payday. These loans can help in emergencies. But they can also be risky.

How Payday Loans Work

You can get a payday loan from a lender. You fill out an application. The lender checks your details. If approved, you get the money. You must repay the loan on time. If not, you pay extra fees.

Can You Have Multiple Payday Loans?

Can you have more than one payday loan? The answer is, it depends. Different places have different rules. Some allow only one loan at a time. Others may allow more. But having many loans can be dangerous.

Why Having Many Loans Is Risky

- High fees: Each loan comes with fees. More loans mean more fees. <liHard to repay: Multiple loans can be hard to repay on time.

- Debt cycle: You might take new loans to repay old ones. This can create a cycle of debt.

Rules in Different States

Different states in the U.S. have different rules. Some states have strict laws. Others are more lenient. Here are some examples:

| State | Number of Loans Allowed |

|---|---|

| California | One loan at a time |

| Texas | Multiple loans allowed |

| New York | Payday loans are banned |

What Happens If You Have Many Loans

Having many payday loans can cause problems. Here are some possible issues:

Financial Stress

Managing many loans is stressful. You may worry about paying them back. This can affect your mental health.

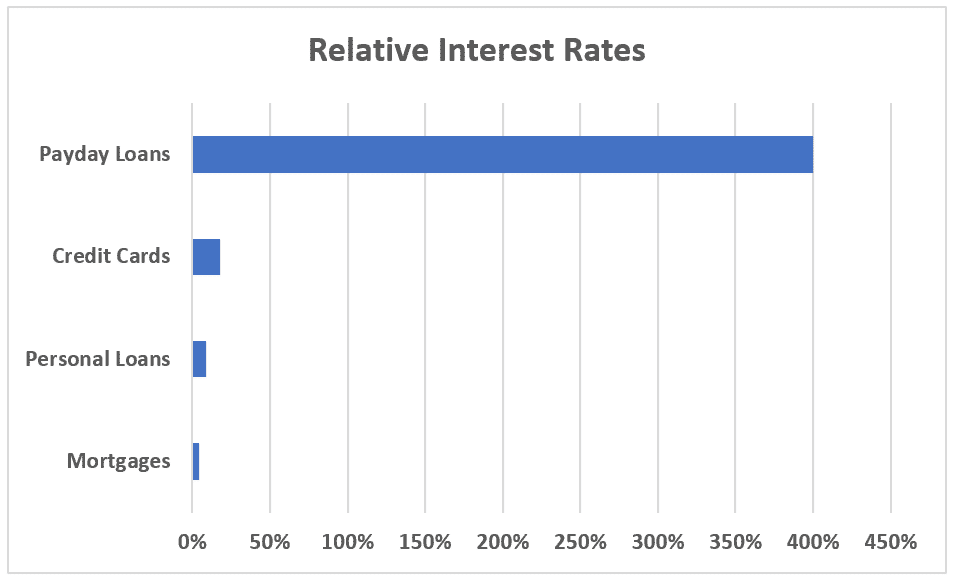

High Interest Rates

Payday loans have high interest rates. More loans mean more interest. This can add up quickly.

Credit Damage

If you miss payments, your credit score can drop. This can make it hard to get other loans in the future.

Tips to Avoid Multiple Payday Loans

It is best to avoid taking many payday loans. Here are some tips:

Plan Your Budget

Create a budget. Stick to it. This can help you avoid needing extra cash.

Save Money

Save a small amount each month. This can help you in emergencies. You may not need a payday loan.

Seek Help

If you are in debt, seek help. Talk to a financial advisor. They can offer good advice.

Alternatives to Payday Loans

If you need money, there are other options. Consider these alternatives:

Personal Loans

Personal loans usually have lower interest rates. They also have longer repayment terms. This can make them easier to manage.

Credit Cards

Using a credit card might be cheaper. But, only if you pay off the balance quickly.

Borrow From Friends Or Family

Consider asking friends or family for help. They may offer a loan with no interest.

Credit: debthammer.org

Frequently Asked Questions

How Many Payday Loans Can You Get At Once?

The number of payday loans you can get varies by state.

Can You Have Multiple Payday Loans At The Same Time?

Yes, but it depends on state laws and lender policies.

What Happens If You Have Multiple Payday Loans?

Managing multiple payday loans can lead to financial stress and higher debt.

Are There Limits On Payday Loans?

Yes, most states have limits on the number of payday loans allowed.

Conclusion

Payday loans can help in emergencies. But, having many loans at once is risky. It is important to understand the rules in your state. Avoid taking too many loans. Plan your budget, save money, and seek help if needed. There are also other options available. Make wise choices to protect your financial health.