Payday loans are short-term loans. People use them for quick cash needs. But, they come with high interest rates. Let’s understand how much interest payday loans charge.

What Are Payday Loans?

Payday loans are small loans. They are due on your next payday. You can get these loans quickly. They help in emergencies. For example, medical bills or car repairs. </p

:max_bytes(150000):strip_icc()/payday-loans.asp-final-882c60fabb124a519dada443015c2eb2.png)

Credit: www.investopedia.com

How Do Payday Loans Work?

You borrow a small amount. You need to repay it on your next payday. The lender charges a fee. This fee acts like interest. You can apply for payday loans online or in stores. The process is quick and easy.

Interest Rates of Payday Loans

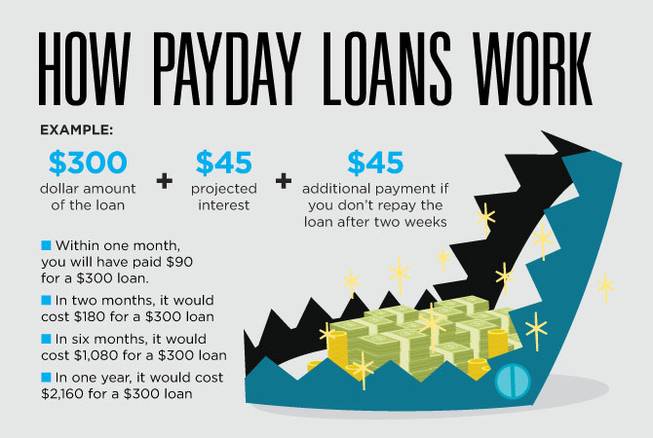

Payday loans have high interest rates. The interest rate is usually a fee per $100 borrowed. This fee can be between $10 and $30 per $100. This means you pay back $110 to $130 for every $100 borrowed.

Let’s look at an example:

| Amount Borrowed | Fee | Total Repayment |

|---|---|---|

| $100 | $15 | $115 |

| $200 | $30 | $230 |

| $300 | $45 | $345 |

Annual Percentage Rate (APR)

Payday loan fees seem small. But, their APR is very high. APR is the yearly cost of a loan. Payday loans can have APRs of 300% to 500%. This is much higher than other loans.

Why Are Payday Loan Rates High?

Payday loans are risky for lenders. Many people do not repay them on time. This risk makes lenders charge high fees. Also, payday loans are short-term. This makes the fees higher compared to longer loans.

How to Calculate Payday Loan Interest

Calculate interest using this formula: Interest = (Fee / Amount Borrowed) 100. For example, if you borrow $100 and the fee is $15, the interest rate is (15/100) 100 = 15%.

Credit: www.pandalawfirm.com

Effects of High Interest Rates

High interest rates can cause problems. They make it hard to repay the loan. Many people need to borrow again to pay off the first loan. This creates a debt cycle. It is hard to escape this cycle.

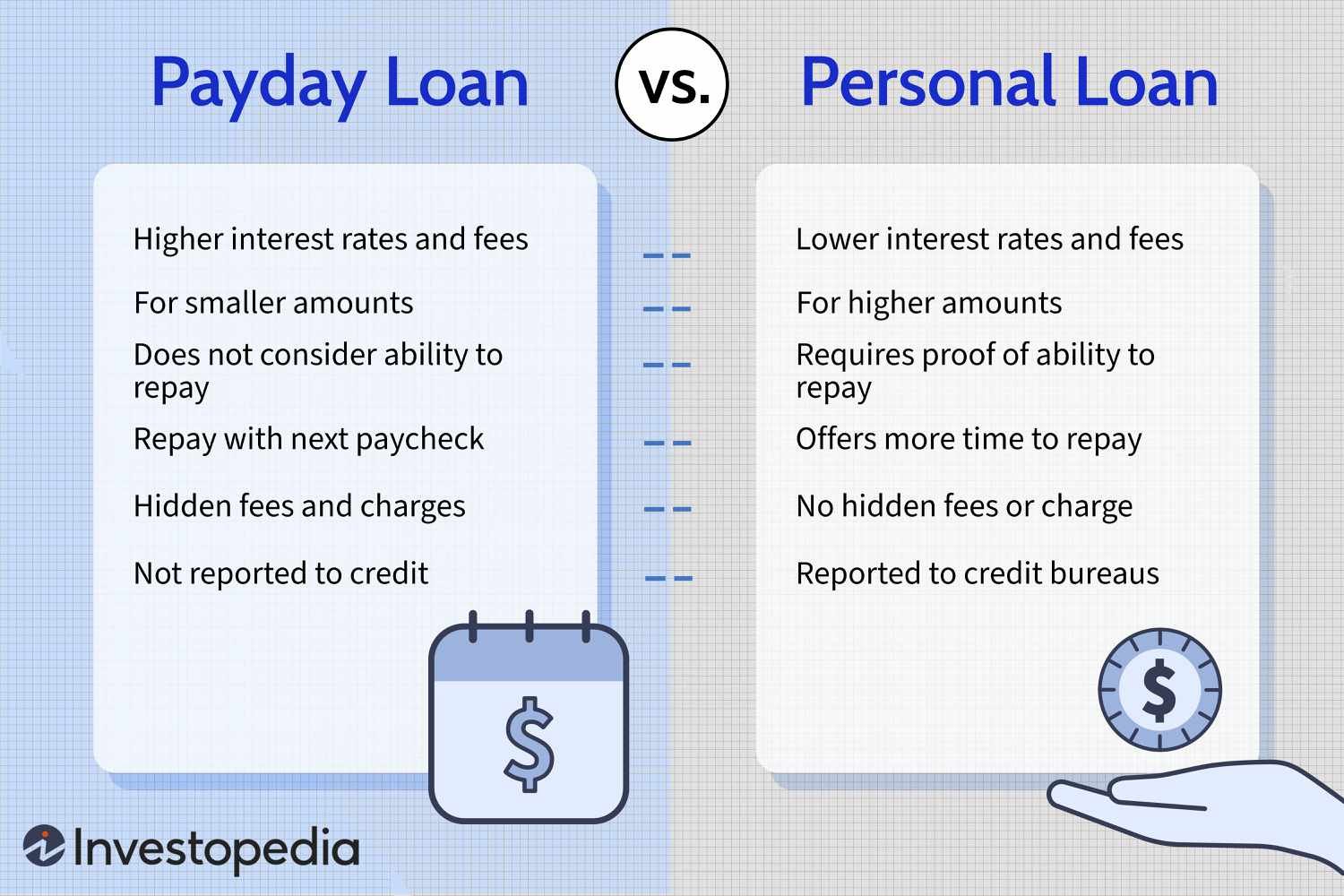

Alternatives to Payday Loans

There are other options for quick cash. Consider these alternatives:

- Ask family or friends for a loan.

- Use a credit card for small expenses.

- Get a personal loan from a bank or credit union.

- Look for local charities that offer help.

Frequently Asked Questions

What Are Payday Loan Interest Rates?

Payday loan interest rates can be very high. They often exceed 400% APR.

How Is Payday Loan Interest Calculated?

Payday loan interest is usually calculated as a fee per $100 borrowed. It can be very costly.

Are Payday Loans More Expensive Than Credit Cards?

Yes, payday loans typically have higher interest rates than credit cards. They can be much more expensive.

Do Payday Loans Have Hidden Fees?

Payday loans can include extra fees. Always read the terms carefully.

Conclusion

Payday loans charge high interest rates. They are useful for emergencies but can be costly. Understand the costs before you borrow. Explore other options if possible. Stay informed and make smart financial choices.