Inflation makes everything more expensive, including loans. But you can still find ways to save money. Locking in a low interest rate during inflation is possible. This guide will help you understand how.

Credit: themortgagereports.com

Understand Inflation

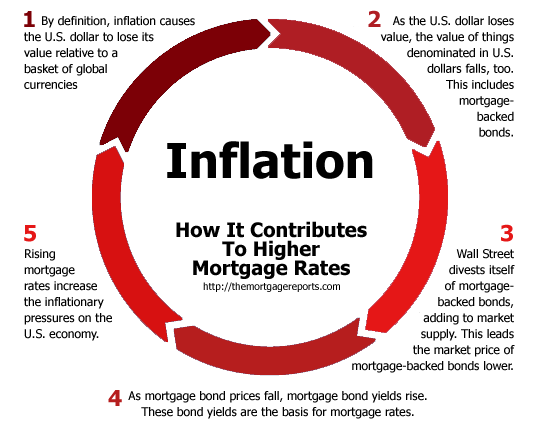

Inflation means prices for goods and services go up. This affects interest rates too. When inflation rises, interest rates often increase. This means borrowing money becomes more expensive.

Why Low Interest Rates are Important

Low interest rates mean you pay less money over time. This is important for loans and mortgages. You can save a lot of money with a lower rate.

Credit: www.indystar.com

Ways to Lock in a Low Interest Rate

Let’s look at some ways to get a low interest rate.

1. Improve Your Credit Score

Your credit score affects the interest rate you get. A higher score usually means a lower rate. You can improve your credit score by:

- Paying bills on time

- Reducing credit card debt

- Checking your credit report for errors

2. Shop Around

Different lenders offer different rates. Compare rates from various lenders. This can help you find the best deal.

3. Consider Fixed-rate Loans

Fixed-rate loans have the same interest rate for the whole term. This can protect you from rising rates during inflation.

4. Lock In Your Rate

Some lenders offer rate locks. This means your interest rate won’t change for a set period. Locking in your rate can save you money if rates go up.

5. Make A Bigger Down Payment

A larger down payment can lead to a lower interest rate. Lenders see you as less risky with more money down.

6. Shorter Loan Terms

Shorter loan terms usually have lower interest rates. You will pay off the loan faster and save money on interest.

7. Negotiate With Lenders

Don’t be afraid to negotiate with lenders. Sometimes, they can offer better rates if you ask.

Steps to Take During the Loan Process

Follow these steps to make sure you get the best rate during the loan process.

Step 1: Check Your Credit Score

Before applying for a loan, check your credit score. Make sure there are no errors. If your score is low, take steps to improve it.

Step 2: Gather Financial Documents

Lenders will ask for financial documents. These include pay stubs, tax returns, and bank statements. Have these ready to speed up the process.

Step 3: Get Pre-approved

Getting pre-approved shows lenders you are serious. It can also give you an idea of what rates you qualify for.

Step 4: Compare Offers

Once you have pre-approval, compare offers from different lenders. Look at the interest rate and other fees.

Step 5: Lock In Your Rate

When you find a good rate, ask the lender to lock it in. This will protect you from rate increases during inflation.

Step 6: Close The Loan

Once your rate is locked, complete the loan process. Review all documents carefully before signing.

Other Tips to Save Money

Here are some extra tips to save money during inflation.

Refinance Existing Loans

If rates drop, consider refinancing your existing loans. This can lower your monthly payments and save you money.

Pay Extra When Possible

Paying extra on your loan can reduce the principal faster. This means you pay less interest over time.

Budget Carefully

During inflation, it’s important to budget carefully. Track your expenses and look for ways to save.

Invest Wisely

Consider investing in assets that do well during inflation. This can help protect your money’s value.

Frequently Asked Questions

How Can I Secure A Low Interest Rate During Inflation?

Refinance your loan. Compare lenders. Lock in rates early.

Does Inflation Affect Interest Rates?

Yes, inflation usually causes interest rates to rise.

Should I Lock My Rate Now Or Wait?

Lock your rate now. Rates may increase with inflation.

What Steps Can I Take To Lock In A Low Rate?

Shop around. Compare offers. Act quickly to lock in.

Conclusion

Locking in a low interest rate during inflation is possible. Improve your credit score, shop around, and consider fixed-rate loans. Follow the loan process steps and use other tips to save money. With careful planning, you can manage your finances well during inflation.