Payday loans are short-term loans. You borrow small amounts of money. You must repay it with your next paycheck. They can be helpful in emergencies. But are they legal? This question is important to understand. Let’s explore the answer together.

What Are Payday Loans?

Payday loans are small, quick loans. You can get them easily. You must pay them back soon. The interest rates can be high. People use them for urgent needs. Like paying bills or fixing a car.

How Do Payday Loans Work?

You apply for a payday loan. The lender checks your details. If approved, you get the money quickly. You must repay it by your next payday. This includes the loan amount and fees.

Who Uses Payday Loans?

Many people use payday loans. They may not have savings. They might have bad credit. They need quick cash. Payday loans can help them in tough times.

Are Payday Loans Legal?

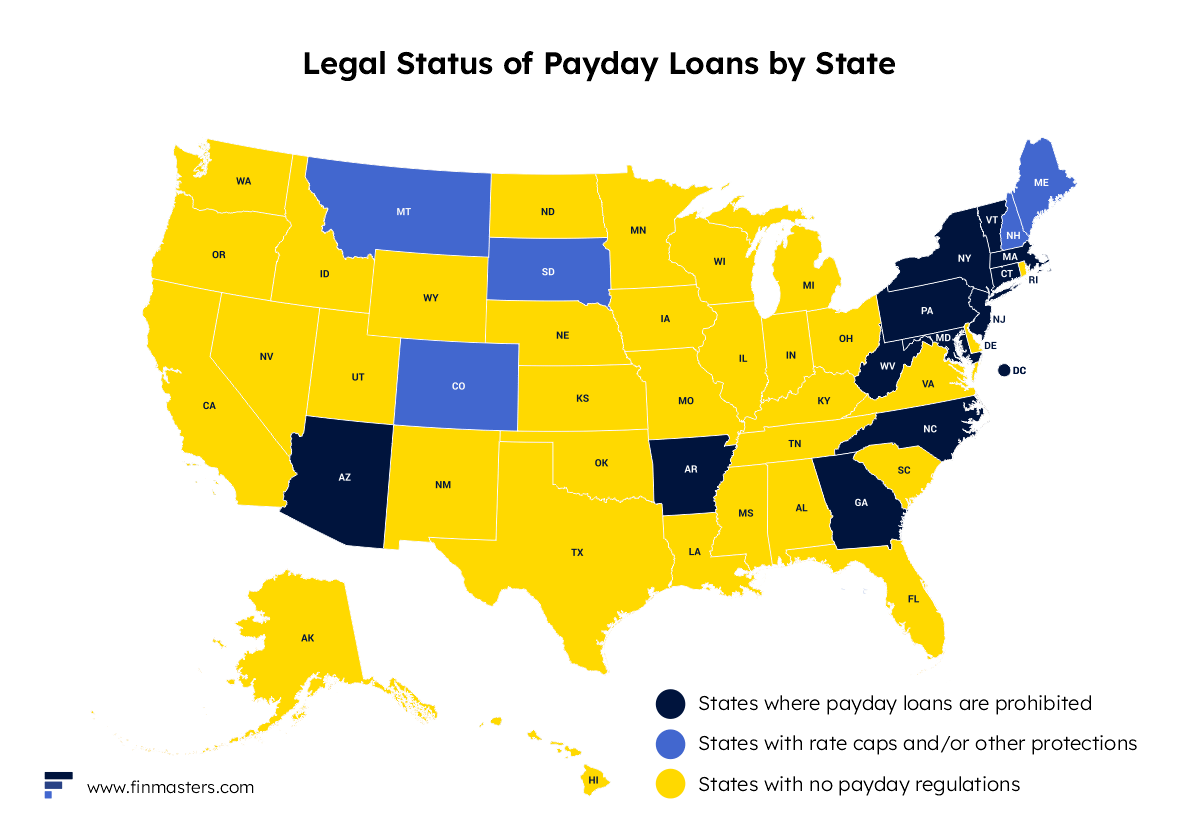

The legality of payday loans varies. It depends on where you live. Some places allow them. Others have strict rules. Some ban them completely. It’s important to know the laws in your area.

Why Are Payday Loans Regulated?

Payday loans can be risky. The high fees and interest rates can trap borrowers. They might keep borrowing to pay old loans. This creates a cycle of debt. Regulations help protect people from this.

States That Allow Payday Loans

Some states allow payday loans. They may have rules to protect borrowers. For example:

- California: Loans up to $300

- Texas: No cap on loan amount

- Florida: Loans up to $500

These states have rules on interest rates and fees. They also limit how many loans you can get.

States With Strict Regulations

Some states allow payday loans but have strict rules. For example:

- Colorado: Loans up to $500 with a max APR of 36%

- Ohio: Loans up to $1,000 with a max APR of 28%

- Virginia: Loans up to $500 with a max APR of 36%

These rules help protect borrowers. They make it harder to fall into debt.

States That Ban Payday Loans

Some states ban payday loans. They believe the risks are too high. For example:

- New York

- New Jersey

- Georgia

In these states, payday loans are not allowed. Lenders cannot operate there.

Credit: en.wikipedia.org

What Are the Risks of Payday Loans?

Payday loans can be risky. Here are some reasons:

- High fees and interest rates

- Short repayment period

- Can lead to more debt

Let’s look at each risk in detail.

High Fees And Interest Rates

Payday loans have high costs. This includes fees and interest rates. You might pay $15-$30 for every $100 borrowed. This adds up quickly.

Short Repayment Period

You must repay payday loans quickly. Usually by your next paycheck. This can be hard if you still have other bills to pay.

Can Lead To More Debt

If you can’t repay, you might borrow again. This creates a cycle. You keep borrowing to pay old loans. Your debt grows.

Alternatives to Payday Loans

There are other options. These can be safer and cheaper. Here are some examples:

- Personal loans

- Credit cards

- Borrowing from friends or family

Let’s explore these alternatives.

Personal Loans

Personal loans can be a good option. They have lower interest rates. You have more time to repay. You can borrow larger amounts. Banks and credit unions offer personal loans.

Credit Cards

Credit cards can help in emergencies. They have lower fees. You can pay back over time. Be careful not to overspend.

Borrowing From Friends Or Family

You can ask friends or family for help. They might lend you money with no interest. Make sure to repay them on time.

Credit: debthammer.org

How to Avoid Payday Loan Scams

Some payday lenders are not honest. They might try to trick you. Here are some tips to stay safe:

- Check if the lender is licensed

- Read the loan terms carefully

- Avoid lenders that ask for upfront fees

Let’s look at each tip in detail.

Check If The Lender Is Licensed

Make sure the lender is legal. Check their license. You can find this information online.

Read The Loan Terms Carefully

Read all the details. Know the fees and interest rates. Understand when you must repay. Don’t sign if you have doubts.

Avoid Lenders That Ask For Upfront Fees

Some lenders ask for fees before giving you a loan. This is a red flag. Avoid these lenders. They might be trying to scam you.

Frequently Asked Questions

Are Payday Loans Legal In The Usa?

Yes, payday loans are legal in the USA. Rules vary by state.

What States Ban Payday Loans?

Some states ban payday loans. For example, Arizona and Georgia.

How Much Can I Borrow With A Payday Loan?

You can borrow up to $500. Amounts depend on state laws.

Are There Interest Limits On Payday Loans?

Yes, some states limit interest rates. Others do not.

Conclusion

Payday loans can be helpful. But they also have risks. The legality depends on where you live. Some states allow them. Others have strict rules. Some ban them completely. Be careful when using payday loans. Know the risks. Consider other options. Stay safe from scams. Make informed decisions. This will help you manage your finances better.