Understanding loan repayment schedules is important. Loans help people buy homes, cars, and start businesses. But, loans must be paid back. This is where repayment schedules come in.

Credit: www.nomadcredit.com

What is a Loan Repayment Schedule?

A loan repayment schedule is a plan. It tells you how much to pay and when. This plan helps you keep track of your payments. It also shows the total amount of interest you will pay.

Parts of a Loan Repayment Schedule

Repayment schedules have key parts:

- Principal

- Interest

- Term

- Payment Amount

Principal

The principal is the amount you borrow. For example, if you borrow $10,000, the principal is $10,000. You must pay back the principal plus interest.

Interest

Interest is the cost of borrowing money. It is a percentage of the principal. For example, if the interest rate is 5%, you pay 5% of the principal in interest.

Term

The term is the length of time you have to repay the loan. Terms can be short or long. A short term might be 2 years. A long term might be 30 years.

Payment Amount

The payment amount is how much you pay each month. This amount includes both principal and interest.

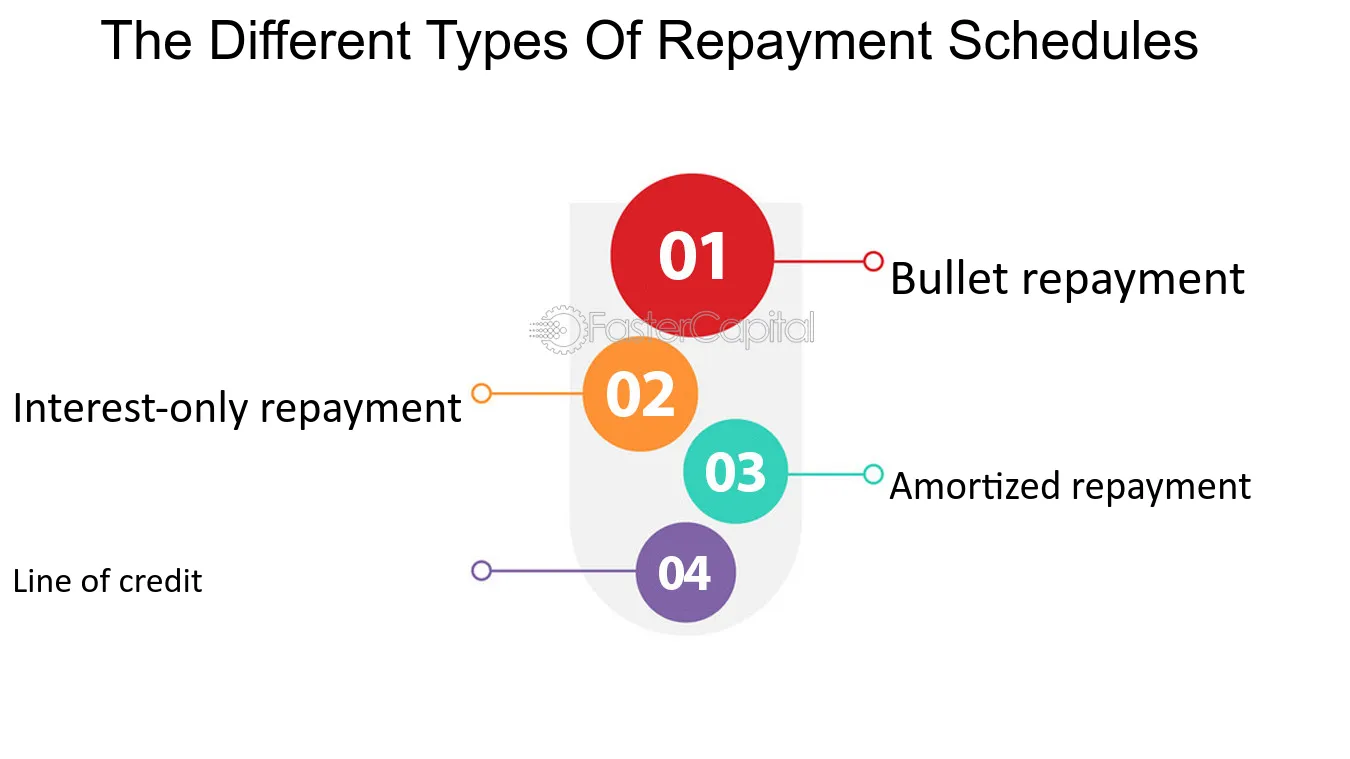

Types of Loans

There are different types of loans. Some common types are:

- Fixed-rate loans

- Adjustable-rate loans

- Interest-only loans

- Balloon loans

Fixed-rate Loans

Fixed-rate loans have a set interest rate. The rate does not change. Your monthly payment stays the same. This makes it easier to budget.

Adjustable-rate Loans

Adjustable-rate loans have a changing interest rate. The rate can go up or down. This means your monthly payment can change. These loans can be riskier.

Interest-only Loans

Interest-only loans let you pay only the interest for a set time. After that, you must pay both principal and interest. This can make payments higher later.

Balloon Loans

Balloon loans have small monthly payments. Then, a large payment is due at the end. This large payment is called a balloon payment.

How to Read a Loan Repayment Schedule

Reading a loan repayment schedule is easy. Here is what to look for:

| Month | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| 1 | $500 | $300 | $200 | $9,700 |

| 2 | $500 | $305 | $195 | $9,395 |

This table shows your payments each month. The payment column shows how much you pay. The principal column shows how much goes to the principal. The interest column shows how much goes to interest. The remaining balance column shows how much you still owe.

:max_bytes(150000):strip_icc()/how-amortization-works-315522_FINAL-8e058e582a744f349593e5c560b46783.png)

Credit: www.thebalancemoney.com

Why Loan Repayment Schedules Matter

Loan repayment schedules are very helpful. They help you see how much you owe. They help you plan your budget. They also help you understand how long it will take to pay off your loan.

Tips for Managing Loan Repayment

Managing loan repayment can be hard. Here are some tips to help:

- Make payments on time

- Pay more than the minimum

- Keep track of your payments

- Talk to your lender if you have trouble

Make Payments On Time

Always make your payments on time. Late payments can hurt your credit score. They can also lead to extra fees.

Pay More Than The Minimum

If you can, pay more than the minimum. This helps you pay off the loan faster. It also reduces the amount of interest you pay.

Keep Track Of Your Payments

Keep track of your payments. Know how much you have paid and how much you still owe. This helps you stay on top of your loan.

Talk To Your Lender If You Have Trouble

If you have trouble making payments, talk to your lender. They may be able to help. They might offer a new payment plan or other options.

Frequently Asked Questions

What Is A Loan Repayment Schedule?

A loan repayment schedule is a plan showing how and when to pay off a loan.

How Is A Loan Repayment Schedule Created?

Lenders create it based on loan terms, interest rates, and repayment period.

Why Is A Loan Repayment Schedule Important?

It helps borrowers manage payments and ensures timely, consistent repayment.

Can I Change My Loan Repayment Schedule?

Yes, but consult your lender. Changes may affect interest and repayment terms.

Conclusion

Understanding loan repayment schedules is important. They help you know how much you owe. They help you plan your budget. They also help you pay off your loan. Follow these tips to manage your loan repayment. It will make the process easier and less stressful.

Remember, always make your payments on time. Pay more than the minimum if you can. Keep track of your payments. And, talk to your lender if you have trouble. With these tips, you can successfully manage your loan repayment.