Payday loans are short-term loans. They help people with urgent needs. But, they have both good and bad sides. Let’s understand them better.

What Are Payday Loans?

Payday loans are small loans. You borrow money until your next payday. They are for emergencies. You can get them fast.

Pros of Payday Loans

Payday loans have some good points. Here are a few:

1. Quick Approval

Payday loans are approved fast. You can get money quickly. Usually, within one day.

2. Easy To Qualify

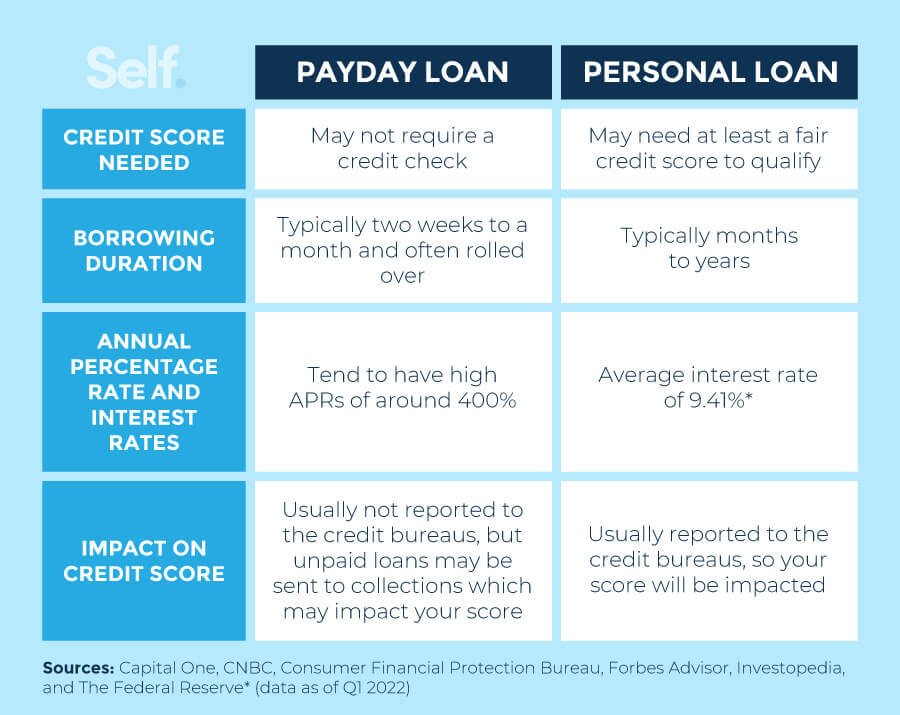

Payday loans are easy to get. You need a job and a bank account. No need for a high credit score.

3. No Credit Check

Payday loans do not check your credit. This is good for people with bad credit.

4. Use For Any Purpose

You can use payday loans for anything. Pay bills, fix your car, or buy groceries.

5. Convenient

Payday loans are very convenient. You can apply online. No need to visit a bank.

Credit: fastercapital.com

Cons of Payday Loans

Payday loans also have some bad points. Here are a few:

1. High-interest Rates

Payday loans have very high-interest rates. You can end up paying a lot more.

2. Short Repayment Terms

You must repay payday loans quickly. Usually within two weeks. This can be hard.

3. Debt Cycle Risk

People may take more payday loans to repay old ones. This creates a debt cycle. It is very dangerous.

4. Fees And Penalties

Payday loans have many fees. Late fees, rollover fees, and more. This increases your debt.

5. Impact On Credit Score

If you do not repay, it hurts your credit score. This affects your future loans.

How Do Payday Loans Work?

Payday loans work simply. Here is a step-by-step process:

- You apply for the loan.

- You provide your job details and bank account.

- The lender approves your loan.

- You get the money in your bank account.

- You repay the loan on your next payday.

When Should You Consider a Payday Loan?

Payday loans are not always bad. Here are some situations when you might consider them:

- You need money urgently.

- You have a plan to repay the loan fast.

- You cannot get a loan from a bank.

- You have no other options.

Credit: www.self.inc

Alternatives to Payday Loans

There are other ways to get money. Here are some alternatives:

1. Personal Loans

Personal loans from banks have lower interest rates. They are better for long-term needs.

2. Credit Card Cash Advance

You can get a cash advance from your credit card. Be careful of high fees.

3. Borrow From Friends Or Family

Ask friends or family for help. This can be a good option.

4. Use Savings

If you have savings, use them. It is better than taking a payday loan.

Frequently Asked Questions

What Are Payday Loans Used For?

Payday loans are used for emergency expenses, like medical bills or car repairs.

Are Payday Loans Easy To Get?

Yes, payday loans are usually easy to get. They have simple requirements.

How Do Payday Loans Work?

You borrow a small amount, then repay it with your next paycheck.

Are Payday Loans Bad For Credit?

Yes, if you fail to repay on time, it can hurt your credit score.

Conclusion

Payday loans have both good and bad sides. They are quick and easy. But, they are expensive and risky. Think carefully before you decide.