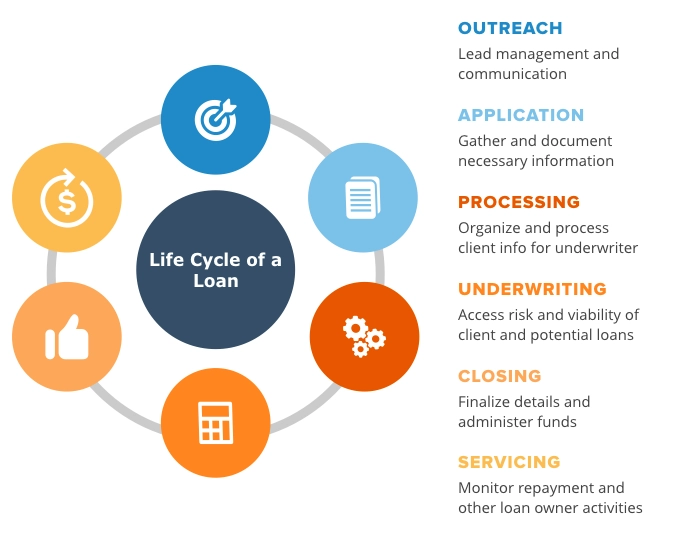

Applying for a loan can be a long process. One key part of this process is providing all the necessary documents. These documents show your financial history and your ability to pay back the loan. But, incomplete documentation can cause many problems. It can delay or even stop your loan approval.

Why Complete Documentation is Important

Lenders need to know if you can repay the loan. They look at your documents to check your financial stability. These documents include:

- Income proof

- Bank statements

- Credit score reports

If any document is missing, it becomes hard for lenders to make a decision. They might think you are hiding something. This can lead to loan denial.

Credit: binariks.com

Common Documents Needed for Loan Approval

Each lender may ask for different documents. However, some documents are commonly required. These include:

| Document Type | Description |

|---|---|

| Income Proof | Payslips or tax returns |

| Bank Statements | Records of your recent transactions |

| Credit Report | Your credit score and history |

| Identification | Proof of identity like a passport or ID card |

These documents help the lender understand your financial situation. They show your income, expenses, and ability to repay the loan.

The Consequences of Incomplete Documentation

Submitting incomplete documents can have serious consequences. Here are some of them:

Delays In Loan Approval

If any document is missing, the lender will ask for it. This back-and-forth process can take time. It can delay your loan approval.

Loan Denial

Lenders need complete information to make a decision. If they do not get it, they may deny your loan application. They might think you are not serious or you are hiding important details.

Higher Interest Rates

Incomplete documents can also lead to higher interest rates. Lenders may see you as a high-risk borrower. They might increase the interest rate to protect themselves.

How to Ensure Complete Documentation

To avoid these issues, make sure your documentation is complete. Here are some tips:

Know The Requirements

Each lender has different requirements. Before you apply, find out what documents are needed. Make a list and gather all the documents.

Double-check Your Documents

Before submitting, check your documents again. Ensure that all information is correct and up-to-date. This will save you from future problems.

Keep Copies

Always keep copies of your documents. If any document gets lost, you will have a backup. This can save time during the application process.

Seek Professional Help

If you are unsure about any document, seek professional help. Financial advisors can guide you. They can ensure that all your documents are complete and correct.

Frequently Asked Questions

Why Is Complete Documentation Crucial For Loan Approval?

Complete documentation is essential for verifying your financial stability and credibility. It ensures a smooth loan approval process.

How Does Incomplete Documentation Affect Loan Approval?

Incomplete documentation can delay the approval process. It may also lead to rejection if key information is missing.

What Documents Are Typically Required For Loan Approval?

Common documents include proof of income, credit history, identification, and property details. These help lenders assess your eligibility.

Can Incomplete Documents Lead To Loan Rejection?

Yes, incomplete documents can cause loan rejection. Lenders need all required information to make an informed decision.

Conclusion

Complete documentation is crucial for loan approval. It helps lenders make an informed decision. Missing or incomplete documents can delay or deny your loan. It is important to know the requirements, double-check your documents, keep copies, and seek help if needed. Following these steps can make your loan application process smoother and quicker.

Remember, the more prepared you are, the better your chances of getting your loan approved. Good luck!