An interest rate is a cost of using money. It is the amount a lender charges a borrower for using their money. It is usually shown as a percentage. This percentage is applied to the amount of money borrowed or saved.

Types of Interest Rates

There are different types of interest rates. Let’s discuss a few common types.

Fixed Interest Rate

A fixed interest rate stays the same over the loan or savings period. It does not change. This can be good for planning. You know what to expect each month.

Variable Interest Rate

A variable interest rate can change over time. It might go up or down. This depends on the market or other factors. It can make payments higher or lower.

Simple Interest Rate

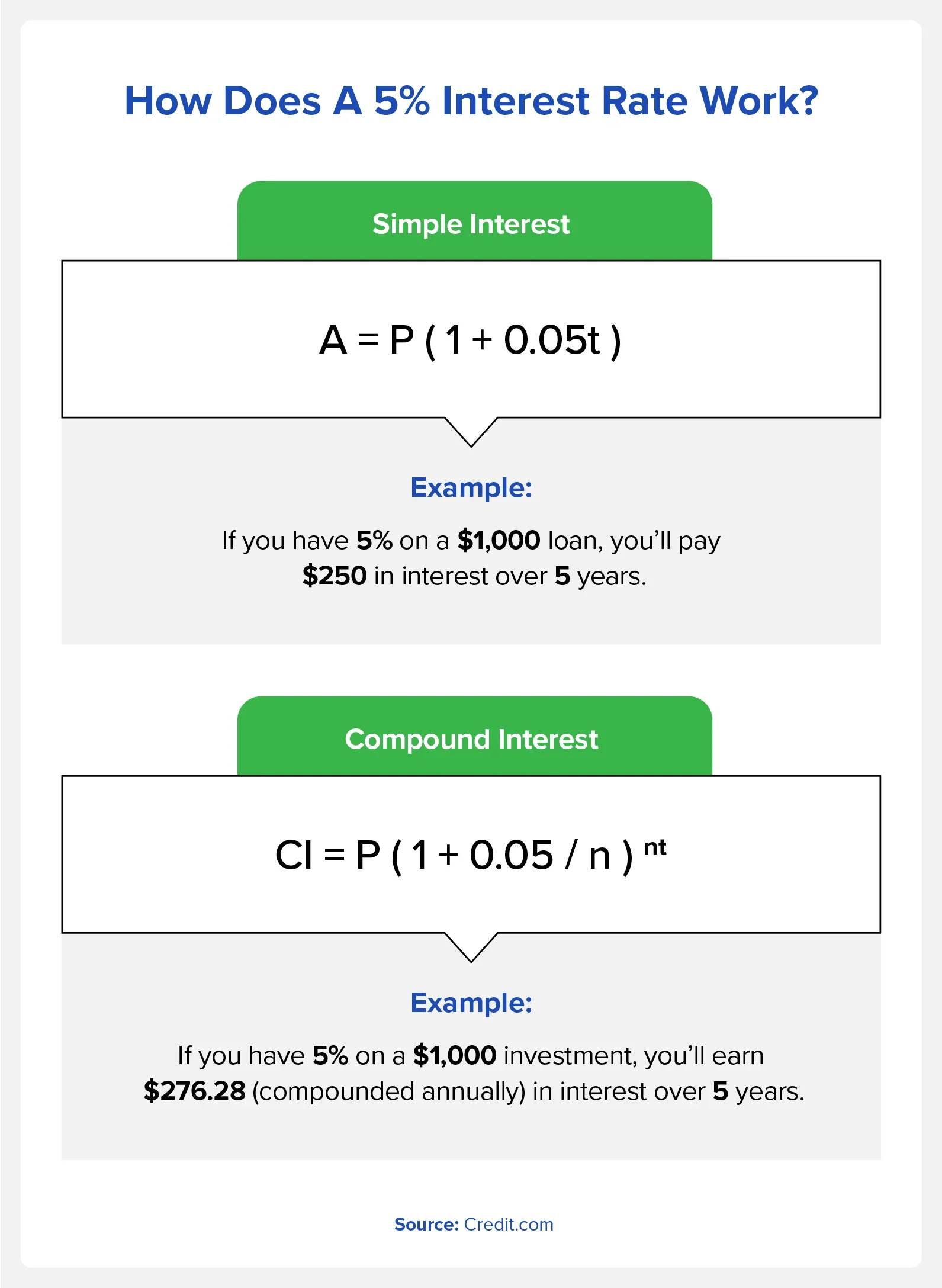

Simple interest is calculated on the principal amount only. The principal is the original amount of money. This means you pay interest only on the initial amount borrowed.

Compound Interest Rate

Compound interest is calculated on the principal amount and also on any interest earned. This means you pay interest on interest. It can make the total amount owed grow faster.

How Interest Rates Work

Interest rates work based on the type of loan or savings. Let’s look at some examples.

Interest Rates On Loans

When you borrow money, you usually have to pay it back with interest. The interest rate determines how much extra you pay. Here is a simple example:

| Loan Amount | Interest Rate | Interest Paid | Total Amount Paid |

|---|---|---|---|

| $1,000 | 5% | $50 | $1,050 |

In this example, you borrowed $1,000 at a 5% interest rate. You will pay $50 in interest. The total amount you pay back is $1,050.

Interest Rates On Savings

When you save money, banks may pay you interest. This is like a reward for keeping your money with them. Here is a simple example:

| Savings Amount | Interest Rate | Interest Earned | Total Amount |

|---|---|---|---|

| $1,000 | 2% | $20 | $1,020 |

In this example, you saved $1,000 at a 2% interest rate. You will earn $20 in interest. Your total savings grow to $1,020.

Credit: etfstore.com

Factors Affecting Interest Rates

Interest rates can change based on several factors. Here are some common ones:

Inflation

Inflation is the rate at which the general level of prices for goods and services rises. Higher inflation usually leads to higher interest rates.

Economic Growth

When the economy grows, interest rates may rise. This is because demand for money increases. More people and businesses want to borrow.

Central Bank Policies

Central banks, like the Federal Reserve, set key interest rates. These rates influence other interest rates in the economy. They may raise or lower rates to control inflation and stabilize the economy.

Credit Score

Your credit score affects the interest rate you get. A higher credit score usually means a lower interest rate. Lenders see you as less risky.

Why Interest Rates Matter

Interest rates matter because they affect our daily lives. They influence how much we pay on loans and how much we earn on savings.

Borrowing Money

If interest rates are high, borrowing money costs more. This can affect big purchases like homes and cars. It can also make credit card debt more expensive.

Savings

If interest rates are high, savings accounts earn more. This encourages people to save money. It can help grow your savings faster.

Investments

Interest rates also affect investments. Higher rates can make bonds more attractive. Lower rates can make stocks more attractive.

Credit: www.credit.com

Frequently Asked Questions

What Is An Interest Rate?

An interest rate is the cost of borrowing money.

How Is Interest Rate Calculated?

Interest rates are calculated based on the principal amount, rate, and time.

Why Do Interest Rates Change?

Interest rates change due to economic conditions and central bank policies.

What Affects Interest Rates?

Inflation, central bank rates, and economic growth affect interest rates.

Conclusion

Interest rates are a key part of our financial world. They affect how much we pay on loans and how much we earn on savings. Understanding interest rates can help you make better financial decisions. Always consider the type of interest rate and how it might change. Stay informed about factors that can affect interest rates. This knowledge can help you plan for the future.