Starting and running a business is hard work. Sometimes, money is needed to make a business grow. This is where a business loan can help. But when is the right time to consider a business loan? Let’s find out.

1. Starting a New Business

Starting a new business requires money. You need money for things like equipment, rent, and supplies. A business loan can help you get started. It can provide the funds you need to open your doors and start serving customers.

2. Expanding Your Business

Is your business doing well? Are you ready to grow? Expansion costs money. You may need a bigger location. You may need more staff. You may need new equipment. A business loan can provide the money you need to expand.

3. Buying Equipment

Every business needs equipment. Equipment can be expensive. A business loan can help you buy the equipment you need. Whether it’s computers, machinery, or vehicles, a loan can help you get what you need to run your business.

4. Managing Cash Flow

Sometimes, money comes in slower than it goes out. This can cause problems. You need money to pay bills and employees. A business loan can help you manage your cash flow. It can give you the money you need to keep things running smoothly.

5. Taking Advantage of Opportunities

Opportunities come and go. Sometimes, you need money to take advantage of them. Maybe there’s a great deal on supplies. Maybe you have a chance to buy out a competitor. A business loan can give you the money you need to seize opportunities.

6. Building Credit for the Future

Good credit is important. It helps you get better loan terms in the future. Taking out a small business loan and paying it back on time can help build your credit. This can make it easier to get loans in the future.

Credit: www.go-yubi.com

7. Covering Unexpected Expenses

Unexpected expenses happen. Equipment breaks. Emergencies arise. A business loan can help you cover these unexpected costs. It can provide the funds you need to handle surprises without disrupting your business.

8. Hiring New Employees

As your business grows, you may need more help. Hiring new employees costs money. A business loan can help you pay for recruitment and training. This allows you to bring in the talent you need to grow your business.

9. Refinancing Existing Debt

Do you already have business debt? You might be able to get better terms. A business loan can help you refinance existing debt. This can lower your monthly payments and make managing debt easier.

10. Marketing and Advertising

Marketing is key to attracting customers. Good marketing can be expensive. A business loan can help you fund marketing campaigns. This can bring in more customers and increase your revenue.

11. Inventory Purchases

Inventory is essential for many businesses. Stocking up on inventory can be costly. A business loan can help you buy the inventory you need. This ensures you can meet customer demand.

Frequently Asked Questions

What Is A Business Loan?

A business loan is borrowed money for business purposes.

When Should You Consider A Business Loan?

Consider a business loan for expansion, equipment, or managing cash flow.

How Can A Business Loan Help In Growth?

It funds new projects, hires, and increased production.

What Are The Types Of Business Loans?

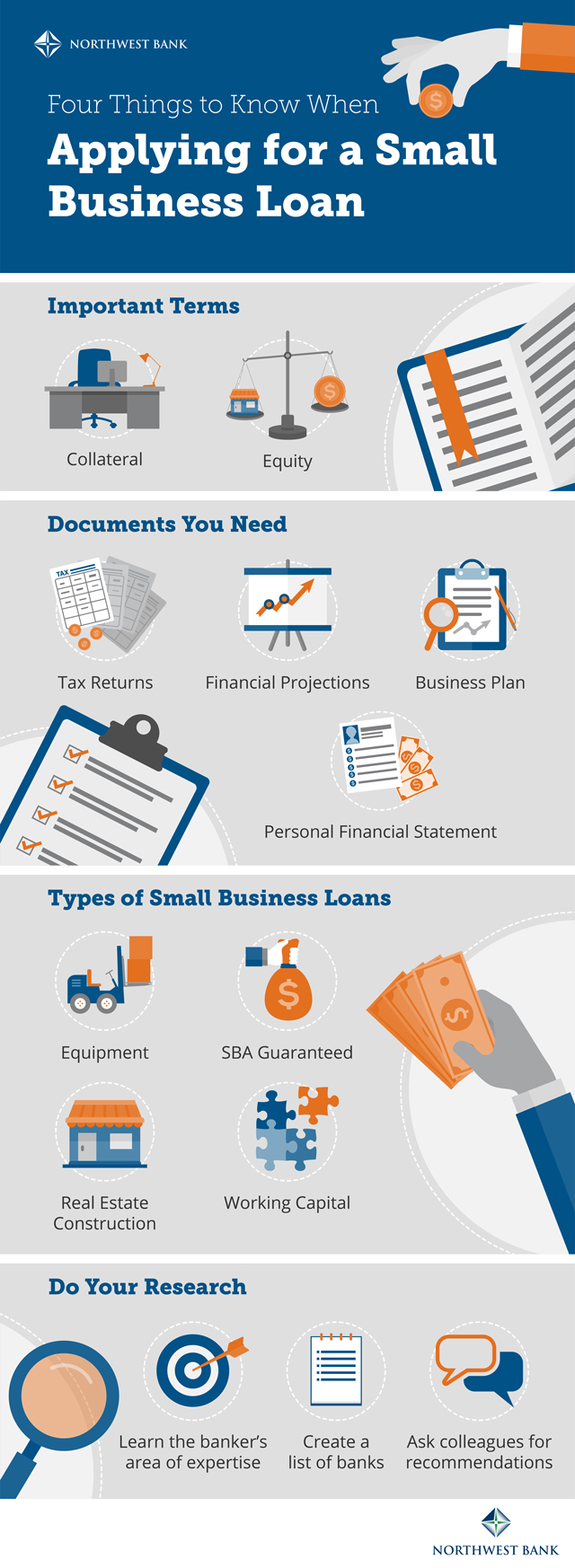

There are term loans, lines of credit, and SBA loans.

Conclusion

A business loan can be a valuable tool. It can help you start, grow, and sustain your business. Consider a loan when you need to start a new business, expand, buy equipment, manage cash flow, seize opportunities, build credit, cover unexpected expenses, hire new employees, refinance debt, fund marketing, or purchase inventory. Make sure to assess your needs carefully. A well-timed loan can help your business reach new heights.